Vultures Wait for the Cluster of Errors

The vultures can’t wait for the real estate bust, they are already circling writes Peter Grant for the Wall Street Journal. The big monied real estate players know this real estate boom is long in the tooth and are raising money to buy up the distressed pieces when the time comes.

“Investors are raising funds to take advantage of busted condominium projects and other distressed property as a correction shows signs of spreading in parts of the commercial real-estate industry,” writes Grant.

Grant points out, “Lately, the pace of sales volume has slowed, which often is a sign that the market has topped out or is about to top out.”

Michael Shah, chief executive of Delshah Capital, plans to be ready, raising $200 million to buy on distressed opportunities. “There’s a drop coming just like when you get to the top of a roller coaster,” he says. The last five years have been quiet in the distressed market, but Mr. Shah says, “This year I’ve picked up four notes worth a total of about $30 million to $40 million.”

In some cases, cap rates are starting to rise,especially for big box power centers. “Their average cap rate rose to 7.31% the first half of this year, compared with 6.92% six months earlier.” Also, delinquency rates are beginning to creep upward. “In July, a Moody’s Investors Service delinquency tracker of a popular type of commercial mortgage-backed security was at 6.7%, compared with 6% at the end of 2016. That’s well below the peak of 10.1% the tracker hit in July 2012. But the current number is much higher than the tracker was at in 2008: 0.5%,” Grant writes.

Economist Murray Rothbard wrote in his book “America’s Great Depression,”

inflation is not the only unfortunate consequence of governmental expansion of the supply of money and credit. For this expansion distorts the structure of investment and production, causing excessive investment in unsound projects in the capital goods industries.This distortion is reflected in the well-known fact that, in every boom period, capital goods prices rise further than the prices of consumer goods. The recession periods of the business cycle then become inevitable, for the recession is the necessary corrective process by which the market liquidates the unsound investments of the boom and redirects resources from the capital goods to the consumer goods industries. The longer the inflationary distortions continue, the more severe the recession-adjustment must become.

Investor Michael Ashner and New York developer Steven Witkoff echo Rothbard’s thesis, “When markets were improving and values were going up, more capital went into real estate construction. Our view is that capital floods in, projects become more tenuous and then there’s a break” for investors.

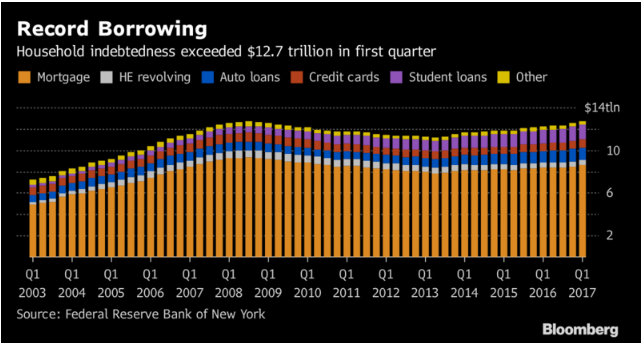

The FDIC’s 2nd quarter statistics are out and the economy is slowing and “After a period of strong lending, it is also typical for defaults to start ticking up as levels of indebtedness rise and bills come due. This is indeed happening, at least among consumers. Credit-card charge-offs soared by 24.5% in the second quarter, according to the FDIC, marking the seventh straight increase. Charge-offs on loans to commercial and industrial borrowers, however, declined by 9.7%, possibly due to a recovering energy sector,” writes Aaron Back.

Back continues, “While good for the banks, rising interest rates are also a symptom of a late-phase expansion, and a potential trigger for an economic slowdown.” As the Fed tightens, even slightly, malinvestments will be exposed.

As Rothbard wrote, “The cluster of error suddenly revealed by entrepreneurs is due to the interventionary distortion of a key market signal—the interest rate.” Vultures are waiting to buy up the errors.