When the public was worried the end of the modern financial world was near, they were stocking up on gold, and presumably canned goods. However, the last few years has proven the coast is clear: paper and computer generated “assets” will do just fine.

All in Economics

Stagflation to take down Keynesians Again

Other than a scattered Austrian here and there, Bernanke and his successor Janet Yellen went about their business unquestioned. Quantitative Easing (QE) was the Keynesian magic wand that kept the ATMs operating on time.

Blockchain-- "crypto-medieval hellhole”

Is blockchain a “futuristic integrity wand”? While it’s hard to tamper with data on the blockchain, the idea that blockchain is a good way to create data that has integrity is false.

Running out of Dr. Copper

Leigh Goehring told Jim Grant copper is headed to $7 a pound, given how many electric vehicles will be built. EVs require three to four times the copper as traditional vehicles. He told Grant it will add 50 percent to the amount of copper demand.

Making America Protectionist Again

So, to use Bannon’s bluster, America innovates, while China’s labor creates the fruit of those innovations cheaper to the benefit of U.S. consumers, including those living in Ohio, Pennsylvania and Michigan.

Central Bank PHDs Will Fail Again

Oliver said the central banks have created such an excess, that when the unwinding occurs and the central banks flood the system with money, it will go into commodities, not securities, “which is exactly where they don’t want it to go.”

Unloved Gold: the Protection Against Central Bank Charlatans

The world’s central bankers and white shoe financial firms have created a mystical never-never land where nothing is real or that can be trusted.

The Art of Madness: Picking a Fight with America's Largest Foreign Creditor

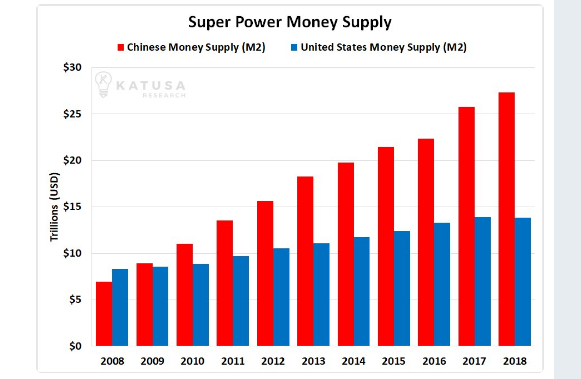

I don’t pretend to have any answers as to the results of this trade kerfuffle, should it happen. However, Jim Grant wrote a couple weeks ago in Grant’s Interest Rate Observer, “The whole world lives at the end of the whip of China’s credit growth.”

Not Such a Wonderful Life: Mortgage Liquidity Crisis

These vulnerabilities are very real, should there be a sudden increase in interest rates or other significant change in the market that causes collateral values to drop. Most nonbank lenders have multiple warehouse lines. However, cross default provisions will trigger a scramble amongst warehouse lenders for a mortgage originator’s assets should it default on one of its lines.

Monetary Ease Spawns Euphoria, Reality Awaits

the easy money chickens are ready to come home to roost. Zero Hedge reports, “legendary trader Paul Tudor Jones (PTJ) argues that US inflation is set to accelerate sharply, making bonds a very poor investment, and that the Fed must act swiftly to tackle financial bubbles created by prolonged monetary easing.”

Recession Predictor: Conceptions

According to Buckles, et al, exuberance in the bedroom, irrational or otherwise, begins to wane prior to a recession.

The Fed says Expectations Cause Inflation

In the heads of the Fed heads, it’s the expectations of us pawns on the Fed’s chessboard which cause the general price level to increase or decrease. Through their Keynesian-colored glasses, in the view of Fed economists, the supply of money has nothing to do with price inflation. The problem is us.

Fed Decelerates True Money Supply Growth, Liquidity Event Dead Ahead

The end of quantitative easing (QE) and the beginning of quantitative tightening (QT) reflects a much tighter Fed today. Peshut writes, “In response to the Fed’s increasingly tighter monetary stance, the growth rate of TMS has decelerated dramatically, from 11.15% YOY in October of 2016 to 3.10% YOY in December of 2017.”

Trump's Tariffs, Fannie's Funding: How High can Rents Climb?

Toby Bozzuto says "That being said, it is a tale of two cities. In the middle income and the lower income markets, people are spending proportionally more on their rent — so much so I believe there's an acute crisis headed our way."

The Fed Makes Your Chicken Expensive

The NYT pair writes, “The fear now is that inflation will start to rise more quickly, potentially crimping global growth or forcing borrowing costs higher,” making it sound like inflation comes and goes with the wind.

Stagflation Appears while the Fed Wonders "Why is Inflation so Low?"

Yes, the economy is putty in the skilled hands toiling at the Eccles Building. Meanwhile, the St. Louis outpost of America’s central bank just published in its latest monthly report “Why is Inflation so Low?”

The Tesla Effect

However, Tesla is the catalyst for all of this development, despite being structurally bankrupt, “which is to say it depends completely on continued capital infusions for its survival,” Montana Skeptic writes on Seeking Alpha.

Searching For Trump's Genius

“Trump had a Clintonesque aura around him,” Smith wrote, “the effervescent divinity of a studied deal-maker, and a categorical ability to communicate and inspire the belief of others in his personal vision. He could no doubt have been an evangelist.”

Central Bank Musical Chairs

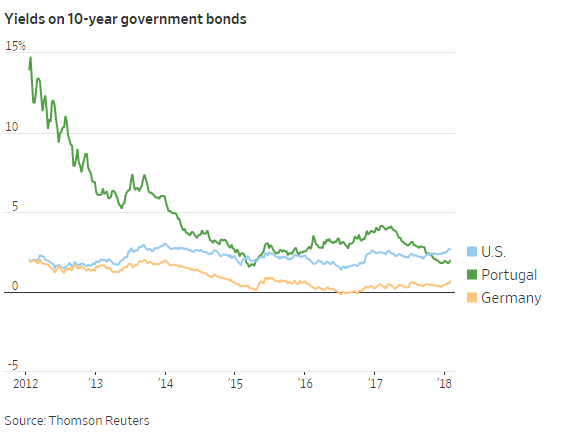

Reversing trillions of dollars worth of securities purchases will create market turmoil. And now that price inflation has entered the equation, the ride is bound to be bumpy. So, who should 401k investors be worried about and keeping an eye on? Bianco and Santelli agree, that person is ECB head man Mario Draghi.

Silicone Hookers and Phony Interest Rates

Financial basket case Greece, has 10-year bonds yielding 3.69%, 69 basis points is all Germany is paying and France’s bonds are yielding 96 basis points. These rates are as fabricated and detached from reality as the silicone sex doll brothels now opening throughout Europe.