Bankers, the Last to Know

Commercial real estate is starting to cool, with deal volume last year dropping 10% from 2015 to $493.7 billion, while, as Peter Grant reports for the Wall Street Journal and Grant’s Interest Rate Observer, “the early stages of 2017 have delivered even weaker results: $50.3 billion in transaction value through March 1 compared to $80.1 billion in the like period in 2015 (a 37.2% yearly drop).”

One would guess bankers would take notice and turn shy. However, Craig Bender of ING real estate, tells the Wall Street Journal: “The banks are hungry. The life insurance groups are hungry”.

It seems Lord Keynes had one thing right when he wrote, “Banks and bankers are by nature blind. They have not seen what was coming…. A ‘sound banker,’ alas! is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him.”

In America’s hottest commercial market, New York, a veritable magnet for hot, cheap, and foreign funds, the first quarter of 2017 was a bust. Large office property sales (those with over 50,000 square feet) that closed in Q1 2017 plunged 63% year-over-year, from $5.54 billion in Q1 2016 to $2.1 billion. It was the lowest transaction amount in any quarter since Q1 2013, writes Wolf Richter.

Not only did the amount of square footage sold nosedive, but the price per square foot fell as well. Richter points out the commercial property bubble has been inflating unabated since 2009. “The big freeze in New York City may be another sign that this bubble too can only go so far, and that peak craziness has been reached,” he writes. “The Fed is now specifically fretting about this commercial real estate bubble, and how to contain it before it takes down the financial system.”

Bankers can’t see around corners. What is in their full view is a tiny 90-day delinquency rate of .59%, a mere fraction of the 4.21% delinquency rate in the dark days at the end of 2010. What’s a banker to do? Make dodgier loans, of course. “Some lenders are competing by making riskier loans such as those that finance construction or occupy a “mezzanine” position between first mortgages and equity. In the first quarter of 2017, construction and land loans on bank balance sheets were up 12.8% to $306.1 billion compared with the same period a year earlier, according to loan tracker Trepp LLC,” writes Grant in the WSJ.

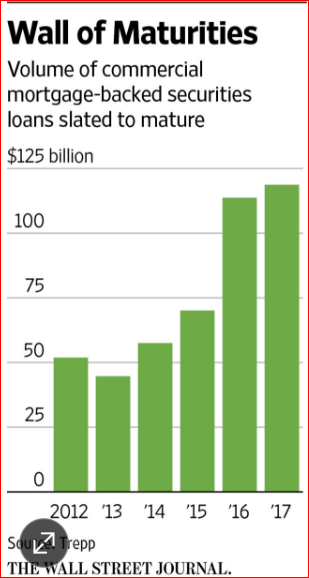

In the meantime a wall of loosely-underwritten, boom-time debt with ten-year maturities are coming due this year. And despite the run-up in values, many borrowers can’t retire these loans. Grant reported last November, “In all, Morningstar Credit Ratings LLC predicts borrowers won’t be able to pay off roughly 40% of the commercial mortgage-backed securities loans coming due [in 2017]. Suburban office properties and shopping centers are being hit particularly hard, said Edward Dittmer, a Morningstar vice president.”

Donald Trump promised to repeal Dodd-Frank, but he’s developed a taste for firing missiles instead. An activity he can order with dinner at War-a-Lago. So the pride of Messrs. Dodd and Frank requiring issuers of commercial mortgage-backed securities to keep at least 5% of the securities they cobble together makes “borrowing more costly and complicated, raising the chances that some property owners won’t be able to refinance loans from the boom years,” Grant speculates.

Low rates have made lenders, not only stay too long at the dance, but believe the party has just begun. The Journal notes that ING just reopened its real estate unit two years ago after shuttering it following the real estate collapse in 2008. Peter Grant mentions a Financial Times quote of Chandler Howard, CEO of Liberty Bank, in Middletown, Conn., on the speculative tone of present-day commercial real-estate lending: “When we’re trying to compete, we see term sheets coming through with interest-only transactions, terms going out longer and longer, some loosening of guarantees.”

Bankers are always the last to know.