After Wolfe’s passing, I read his last, “The Kingdom of Speech,” a book that was reportedly “not well received by critics.” Many of his books weren’t “well received” yet sold well enough for him to live in a 12-room apartment in New York.

Problem Canary in Bank Coal Mine?

The number of problem banks was only 92 at quarter end, the assets of problem banks more than tripled to more than $60 billion. That means two or three banks of considerable size are now considered “problem” banks. The regulator doesn’t say which banks, so lines don’t form outside.

Trouble in Euroland

Little old Italy, you might ask. While small in land mass, the Italian government has borrowed mightily: the fourth largest bond market in the world, behind, China, Japan and you know who.

Eisman of 'Big Short' Fame Doesn't Believe Cryptocurrencies Have Value

Eisman joins Warren Buffet in dissing cryptos in recent days. The Oracle of Omaha had harsher words for digital currencies, calling them, “probably rat poison squared’ and predicted cryptocurrencies “almost certainly...will come to a bad ending.”

Malamud Retires, Remembering Rothbard

Imagine how different the History of Thought class was with Rothbard (his 2 volume “An Austrian Perspective on the History of Economic Thought” was essentially his lectures) as opposed to Malamud’s version.

Think and Decide Like a Poker Player

Mr. Books the gunfighter was thinking the way poker players think: in bets. Former poker pro Annie Duke’s new book Thinking in Bets: Making Smarter Decisions When You Don't Have All the Facts, makes us think of our decision making not in a 50/50 way, or a zero percent--100 percent way, but account for those unknowns or as Books said, have “that third eye.”

Demand for Gold Coins Crashes

When the public was worried the end of the modern financial world was near, they were stocking up on gold, and presumably canned goods. However, the last few years has proven the coast is clear: paper and computer generated “assets” will do just fine.

Millennial Candidates embrace Socialism, while Venezuela Chokes on it

Socialism has oozed out of college classrooms and into the ballot box. “Yes, I’m running as a socialist,” Mr. Bynum told the New York Times. “I’m a far-left candidate. What I’m trying to do is be a Democrat who actually stands for something, and tells people, ‘Here’s how we are going to materially improve conditions in your life.’”

Stagflation to take down Keynesians Again

Other than a scattered Austrian here and there, Bernanke and his successor Janet Yellen went about their business unquestioned. Quantitative Easing (QE) was the Keynesian magic wand that kept the ATMs operating on time.

Blockchain-- "crypto-medieval hellhole”

Is blockchain a “futuristic integrity wand”? While it’s hard to tamper with data on the blockchain, the idea that blockchain is a good way to create data that has integrity is false.

Running out of Dr. Copper

Leigh Goehring told Jim Grant copper is headed to $7 a pound, given how many electric vehicles will be built. EVs require three to four times the copper as traditional vehicles. He told Grant it will add 50 percent to the amount of copper demand.

Making America Protectionist Again

So, to use Bannon’s bluster, America innovates, while China’s labor creates the fruit of those innovations cheaper to the benefit of U.S. consumers, including those living in Ohio, Pennsylvania and Michigan.

Central Bank PHDs Will Fail Again

Oliver said the central banks have created such an excess, that when the unwinding occurs and the central banks flood the system with money, it will go into commodities, not securities, “which is exactly where they don’t want it to go.”

Unloved Gold: the Protection Against Central Bank Charlatans

The world’s central bankers and white shoe financial firms have created a mystical never-never land where nothing is real or that can be trusted.

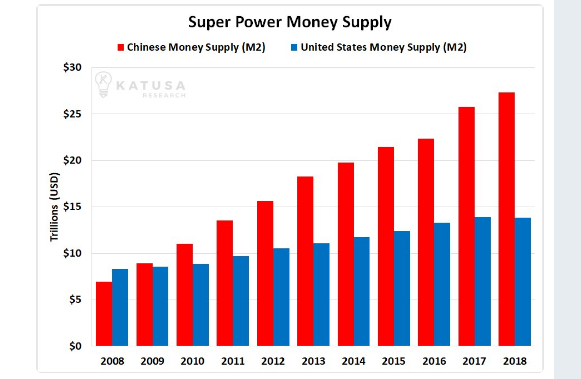

The Art of Madness: Picking a Fight with America's Largest Foreign Creditor

I don’t pretend to have any answers as to the results of this trade kerfuffle, should it happen. However, Jim Grant wrote a couple weeks ago in Grant’s Interest Rate Observer, “The whole world lives at the end of the whip of China’s credit growth.”

America's Fantasy

Kurt Andersen writes in his book “Fantasyland How America went haywire: A 500-year history,” the current president is “stupendous Exhibit A” in the landscape of “Fantasyland,” a fitting leader for a nation that has, over the centuries, nurtured a “promiscuous devotion to the untrue.”

Not Such a Wonderful Life: Mortgage Liquidity Crisis

These vulnerabilities are very real, should there be a sudden increase in interest rates or other significant change in the market that causes collateral values to drop. Most nonbank lenders have multiple warehouse lines. However, cross default provisions will trigger a scramble amongst warehouse lenders for a mortgage originator’s assets should it default on one of its lines.

Monetary Ease Spawns Euphoria, Reality Awaits

the easy money chickens are ready to come home to roost. Zero Hedge reports, “legendary trader Paul Tudor Jones (PTJ) argues that US inflation is set to accelerate sharply, making bonds a very poor investment, and that the Fed must act swiftly to tackle financial bubbles created by prolonged monetary easing.”

Recession Predictor: Conceptions

According to Buckles, et al, exuberance in the bedroom, irrational or otherwise, begins to wane prior to a recession.

The Fed says Expectations Cause Inflation

In the heads of the Fed heads, it’s the expectations of us pawns on the Fed’s chessboard which cause the general price level to increase or decrease. Through their Keynesian-colored glasses, in the view of Fed economists, the supply of money has nothing to do with price inflation. The problem is us.