Bitcoin 40,000: They Ain't Makin' Too Many More

Supposedly Mark Twain said, “Buy land, they ain’t making it anymore.” Twain, who experienced plenty of financial ups and downs in his life, doesn’t mentioned that land values are still subject to gravity on occasion.

However, the current bubble craze is Bitcoin and while more can be made--up to 21 million--the current boom is just getting started according to Former Fortress hedge fund manager Michael Novogratz.

You see, Bitcoin is on it’s way to $40,000 per coin, because, he tells CNBC,

What's different about these coins than other commodities ... there is no supply response here, So it's a speculator's dream in that as buying happens there's no new supply response that comes up. So every price move gets exaggerated. It's going to get exaggerated on the way up.

In other words, they ain’t makin’ too much more of it.

The former Fortress man finishes his thought with, “There will be 50 percent corrections. It will get exaggerated on the way down."

Novogratz has chugged the crypto-Kool-aid and has "probably over 20 percent" or "maybe even 30 percent" of his net worth is in cryptocurrencies, split roughly in half between bitcoin and ethereum.

Novogratz said he bought $15 million to $20 million worth of the digital currency, when the crypto-currency fell 20% in November. However, he recommends that retail speculators put just 1% to 3% of their net worth.

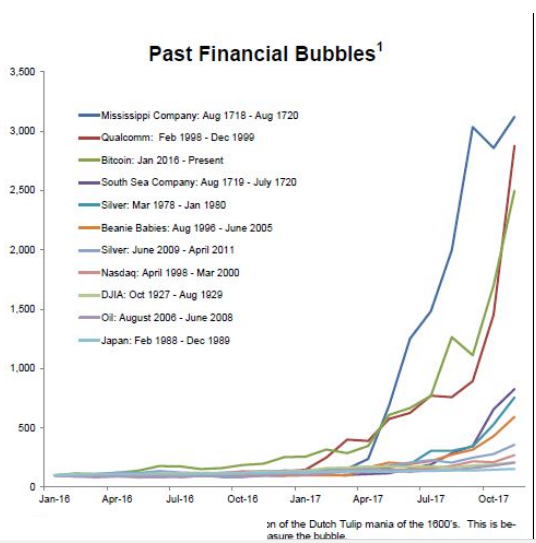

Meanwhile, crusty old Art Cashin, UBS director of floor operations at the New York Stock Exchange, told CNBC's "Squawk on the Street" that "bitcoin has gone parabolic. I think we're in the fear-of-missing-out phase now." He said, “that usually doesn’t end well.”

In his Daily Rap, Bill Fleckenstein writes, “Of course, nothing typifies the madness of the digital crowd and its belief in Santa Claus better than Bitcoin, which went wild over the weekend, trading up almost 20%, and knocking on the door of $10,000. So, despite my belief that it is worth virtually nothing, it continues to explode, in just another manifestation of the mania.”

The Doomsday wing of the Libertarian crowd has switch from gold to Bitcoin, Bloomberg reports, despite Bitcoin’s questionable usefulness if the power grid goes down.

The first lady of liberty, Wendy McElroy, told Bloomberg ““I consider bitcoin to be a currency on the same level as gold, it allows individuals to become self-bankers. When I fully understood the concepts and their significance, bitcoin became a fascination.”

McElroy is writing a book about crypto-currencies.

“Not too long ago, people in the prepper community were actively warning against crypto, and now they’re all investing in it,” said Tom Martin, a truck driver from Washington who runs a social-media website for people interested in learning skills to survive disaster. “As long as the grid stays up, people will keep using bitcoin.”

Contrarians might consider this, “Buy bitcoin” is now a more popular search phrase than “buy gold” on Google.