The Politics of Mining

After a tough few years major miners are loaded with cash reports the Wall Street Journal. Scott Patterson writes, “Fueled by a sharp rise in commodities prices, companies like BHP Billiton Ltd. ,Glencore PLC and Rio Tinto PLC are flush with cash again, boosting dividends, cutting debt and shelling out cash for expansion projects. Just a couple of years ago, they were scrambling to survive in the midst of a historic downturn.”

The big three miners have cut their collective debt in half from 2014 and now the question is what do they do? “The question for investors is whether miners will continue to pay down debt—and boost dividends—or, lured by rising commodity prices, return to the big-spending ways that got them into trouble two years ago,” writes Patterson.

Paul Gait, a Bernstein mining-industry analyst, thinks the miners will keep their powder dry as the tough times still cloud their memories. “I don’t think management wants to live through the volatility that we saw in the last few years and the near-death experience many of these companies saw,” Mr. Gait said.

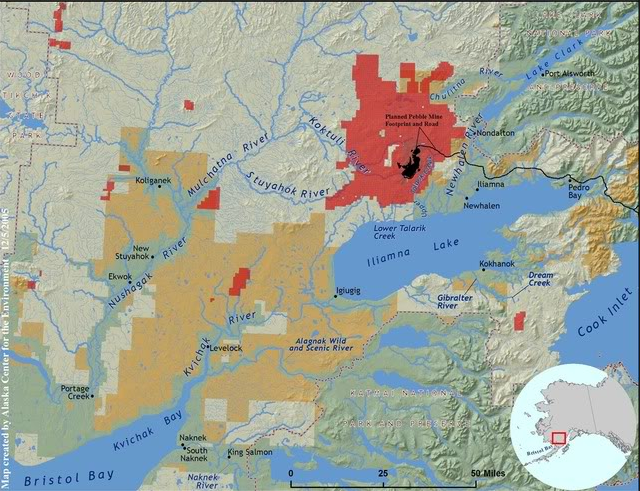

But one wonders about the Pebble project in Alaska owned by junior miner Northern Dynasty Minerals. In a 38-page analysis for Cantor Fitzgerald Mike Kozak makes a compelling case for one of the majors to JV with tiny Northern Dynasty on a mine with the potential of producing one million ounces of gold and 900 million pounds of copper a year for 80 years.

Lots of money has been poured into Pebble, but nothing has been approved, let alone produced, as the EPA dropped a roadblock in front of the property. Plus, the environmentalists continually stretch the truth to stymie the project.

Give the Trump Administration credit, in February a Congressional Committee told the EPA Commissioner to withdraw the agency’s veto. In May, Northern Dynasty reached an agreement with the EPA and the company may now proceed with normal course permitting.

Paul Lebo, CFA writes on Seeking Alpha,

During the Obama administration, the EPA placed a preemptive veto on development of the Pebble Mine with the thesis that it could harm the salmon fishing business in Bristol Bay, which is greater than 100 miles from the Pebble Mine. In the years leading up to the veto, NAK had two partners, Anglo American (OTCPK:AAUKF) and Rio (NYSE:RIO). Around the time of the veto, both withdrew from the partnership and donated their shares to charity. Fast forward 6 years and the veto has been lifted by Scott Pruitt and team at President Trump's EPA.

We’re still talking about 30 months for permitting and 4 years to do a environmental impact statement. However, suddenly, with a simple change of administration the largest mine in the world--81 billion pounds of copper and 107 million ounces of gold--has a chance to come to fruition.