Roe v. Wade caused the housing crash?

Roe v. Wade caused the housing crash. I heard this theory for the first time a couple weeks ago from Barry Habib, mortgage guru and winner of the Crystal Ball Award for being the top real estate forecaster in America.

Mr. Habib’s hero is Lee Iacocca, best known for resurrecting Chrysler, but first earning his chops at Ford and spearheading the making of the Mustang and then the mini-van. Both decisions were made studying demographics. Young baby boomers wanted to sow their wild oats. Then, when they became older they needed big vehicles to haul their kids and soccer balls around.

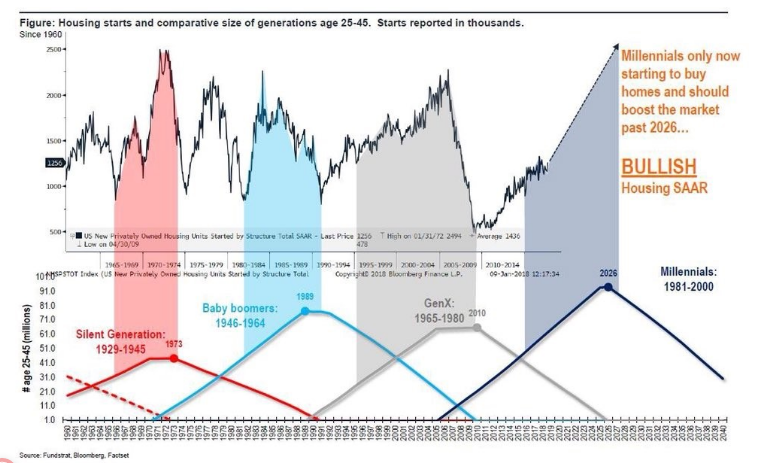

So, Roe v. Wade made legal abortion the law of the land in 1973 and young families typically buy their first house at age 33. Add those two together and, wha-la, 2006--the absolute peak in housing prices occurs. We know what happens next. Habib told the packed room, “if builders would have consulted their inner Iacocca's, they wouldn’t have built so many homes.” A significant number of future home buyers had been aborted starting 33 years before.

Okay, so there was the Fed’s lowering interest rates, the government’s program to increase the country’s home ownership percentage, the creation of exotic mortgage derivatives on Wall Street, and the need for mortgages to fill the demand for those products. However, in the end, according to Habib, the man with a crystal ball, says the Supreme Court kneecapped the housing market.

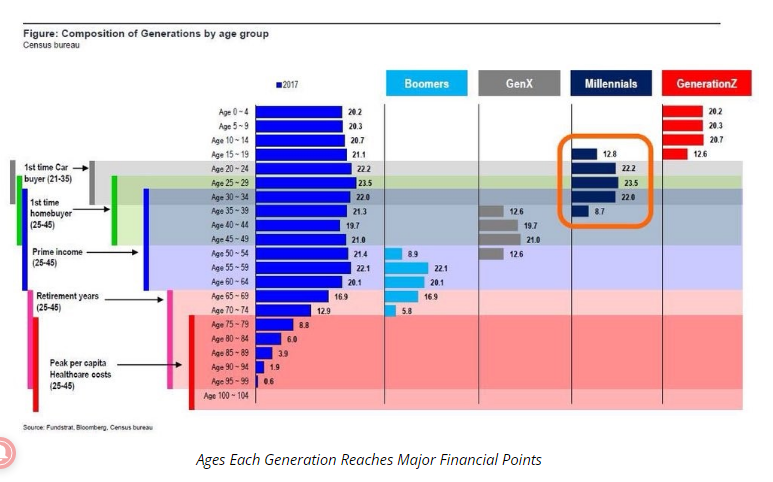

So, now what? Millenials are starting to buy homes and they will be buying for the next decade. As for supply, the crash put many homebuilders out of business along with the banks that financed them and the subcontractors who did the work. Timemoney.com says, “millennials making key life decisions later, pushes their housing purchase a few years off, but it still will probably be occurring en masse in the next decade.”

However, building the homes will be a challenge. The current administration is not pro-immigration, creating a "point that there is a serious shortage of workers," Jerry Howard, CEO of the National Association of Home Builders told cnnmoney.com. "It's a real problem that ripples throughout the home-building process that ultimately costs the consumer."

"A lot of workers went back to Mexico," said Alan Laing, executive vice president at Taylor Morrison Home Corporation, a national home builder. "The Mexican economy has improved during that time so it's not a compelling proposition to come here. The immigration policies and employment practices make it harder for undocumented workers to gain employment."

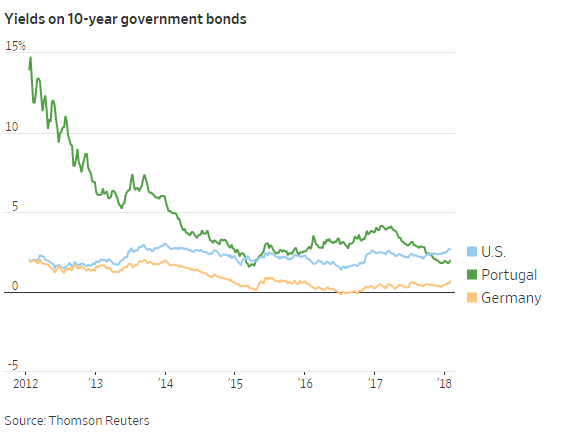

Of course millenials are already saddled with student loan debt and the job market and wage growth for college grads has been far from robust. Also, one of these days, mortgage rates will rise, making payments less affordable. Also, entry-level housing is difficult to get approved at City Hall. This post on Minnpost.com captures the feeling of existing homeowners. “Poor people belong in cities, not in suburbs, and definitely not in mine. Sleep in your car, on a sofa in your cousin’s house, under a bridge — anywhere but next door to me.”

If Roe v. Wade were overturned (or not), home ownership in America may become something few can afford.