Irrational Apartment Exuberance

The Lotus apartment project has been sold, with the 295 units changing hands for $76.7 million or $260,000 per door. The project’s developer, Jonathan Fiore has the project 82 percent leased, but didn’t have the project for sale. However, as the las Vega Review-Journal’s Eli Segal explains,

Lotus, which features ground-floor retail space, a rooftop deck, a poolside DJ booth and a karaoke room, was not on the market, Fore said. But Green Leaf approached him about buying it, and he wanted to reinvest the funds in an apartment complex he’s building near the Rio, he said.

The sales price is reportedly double the valley average, but this writer has heard of another apartment project sale at $300,000 per unit. In February of 2017, I wrote about the Lotus and its quirky location on LewRockwell.com,

A 295-unit project, appropriately called Lotus, is under construction a mile west of the Strip near Chinatown. Tenants will have a short walk to the Adult Superstore. A block or so in the opposite direction is strip club Play It Again Sam’s. To live in this, shall we say, eclectic neighborhood, Lotus will offer units ranging from 667-square-foot studios for $1,000 per month ($1.50/sf) to three-bedroom, 1,400-square-foot units at around $2,500 per month ($1.61/sf).

The high rents reflect the high price of the land. Jonathan Fore, of Fore Property Company, told the Review Journal he paid $1.1 million per acre for the site, more than double what developers pay for similarly zoned land in more suburban areas of Las Vegas.

Those “high rents” I referred to are now commonplace around the Las Vegas valley. I toured a project recently, located far from the strip, but with all the bells-and-whistles the Lotus has, and the owner told me he is earning $1.80/sf a month. He told me his project wasn’t for sale. We’ll see.

Segall writes, “ARA Newmark broker Curt Allsop said it’s mostly an issue of risk tolerance, but a lot of developers like taking the merchant builder [build, lease-up, and sell] approach ‘in a super-hot market.’”

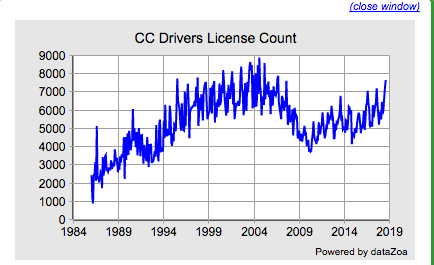

A super-hot apartment market is what Sin City enjoys with 7,652 out-of-state licenses turned in at the various DMV offices in August, up slightly from 7,219 turned in July.

In addition to the NFL’s Raiders, Silicon Valley’s Google is coming to the Vegas Valley with a data facility with 50 permanent jobs. But, let’s not forget the 3,000 construction workers slated to work on the project.

Nothing says boom like construction employment: Raiders stadium, LVCVA expansion, Raiders practice facility, Resorts World, Project Neon, Wynn convention expansion, the Sphere, and now Google, just to name a few.

As for rents, some wonder how high they can go. “What’s the limit?” [John] Stater said of the rising rents. “That’s what the market figures out. That’s why we have things like booms and busts and recessions. Everybody’s guessing.”

A architect friend who draws apartment projects, among other things, told me he received five new apartment jobs just last month. These are project contemplated by experienced apartment developers. The red-hot sector has attracted some would-be developers, he says, who only have land identified but no clue how to complete a project.

It smells like irrational exuberance.