Wage Earners Never Catch Up

“The Labor Department reported Friday that worker payrolls expanded by 201,000 in August and private-sector hourly wages grew 2.9% from a year earlier,” today’s Wall Street Journal reported.

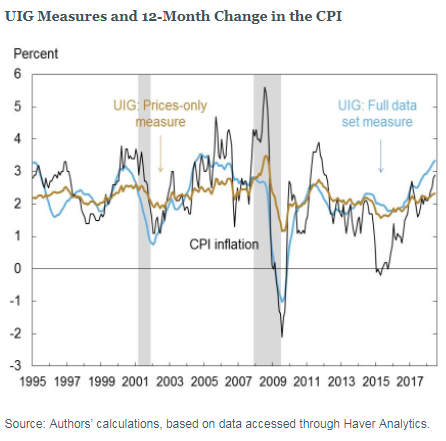

Meanwhile, Ryan McMaken reports on mises.org that the Fed has a new inflation gauge that’s reflecting “the highest rate recorded in 158 months, or more than 13 years. The last time the UIG [underlying inflation gauge] measure was as high was in April 2005, when it was at 3.36 percent.”

The UIG comprises,

data from the following two broad categories: (1) consumer, producer, and import prices for goods and services and (2) nonprice variables such as labor market measures, money aggregates, producer surveys, and financial variables (short- and long-term government interest rates, corporate and high-yield bonds, consumer credit volumes and real estate loans, stocks, and commodity prices).

So prices are rising, and wages, as always, aren’t keeping up. According to Pew Research,

After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.

So how is everyone, seemingly, buying all those new gadgets? Consumer lending is setting records. That’s how. In the August 24th edition of the WSJ, AnnaMaria Andriotis and Peter Rudegeair write,

Lenders extended $81.9 billion in personal loans to U.S. consumers in the first half of the year, up about 13% from a year prior, according to credit-reporting firm Experian PLC. That compares with a 9% rise in auto loans and leases and a 5% boost in spending limits issued on new general-purpose credit cards over the same period.

Personal loans are unsecured, so are much riskier than lending on cars and homes. However, lenders want to get money out the door so they,

pitch the loans as a way for consumers to pay for projects or activities that might have otherwise taken months to save for. “Take a trip,” says an offer from Barclays PLC. “Add a new deck, patio or pool,” says one from Citizens Financial Group Inc.

All of this debt is on top of $1.04 trllion in credit card debt and $1.5 trillion in student loan debt.

U.S. Consumers and their lenders are seeing the world through Trump’s rose colored glasses. So much to buy and not enough time to save for it! Plus, the Fed’s inflation will chip away at their debts. For poor working stiffs who save, Ludwig von Mises wrote,

These victims, by and large, are the same kind of people ”roughly, the middle classes” who are injured as creditors through the depreciation of their bank savings, insurance policies, pensions, etc. The salaries of teachers and ministers, the fees of doctors, go up only slowly as compared to the tempo with which prices of food, rent, clothing, and so on, go up. There is always a considerable time lag between the increase in the money income of the white-collar workers and professional people and the increase in costs of food, clothing, and other necessities.

One wonders what could go wrong as we near the 10th anniversary of the Lehman Brothers bankruptcy filing.