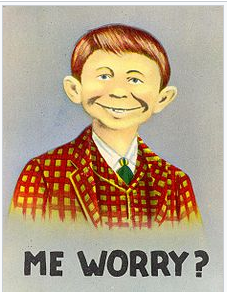

The Trouble with Complacency

After the December stock market crash, the new year has brought a more dovish Federal Reserve. Chair Jerome Powell has found Donald J. Trump’s religion, implying a throttling of balance sheet runoff and rate hiking. The market has responded.

“Epic Complacency” is the title of Robert Prechter’s latest “The Elliott Wave Theorist.” Prechter writes, “If the Dow ultimately makes it to a new highs it won’t be bullish.” But how couldn’t it be?

Alex Pollock reminds us of “Minsky’s Principle as Stated in Rome, 30 AD: The most common beginning of disaster was a sense of security.”

Everything is A-OK and warm and fuzzy for the investing public. “Social optimism is evident everywhere,” writes Prechter. “Optimistic investment in stocks and junk bonds remain at historically high levels. Indebtedness is also historically high. Student loans are at a record. Auto loans--many of them for SUVs, muscle cars and tricked-up trucks--are at a record.”

One fly in this prosperity ointment was tweeted last week,

A record 7 million Americans are 90 days+ behind on their auto loan payments, a red flag for the economy, @NewYorkFed reports.

It's a million more people behind than during the financial crisis era. Many are under 30 years old.

“This is a fragile condition,” Prechter writes.

Experts are looking to China or Europe for a potential spark to start a liquidity event, crash, and recession. But, Tom Holland wrote a month ago in the South China Morning Post,

Instead, it is more likely that the world’s next big financial crash will originate in the United States. And while there will be differences from the 2008 crisis, there will also be telling similarities; history doesn’t repeat, but it does rhyme.

America has been on a borrowing binge as Holland points out. Trillions are owed by borrowers considered less than investment grade. Holland writes, “over the last 10 years, the value of US corporate bonds outstanding has tripled from about US$2.5 trillion to US$7.5 trillion. And of that amount, roughly 45 percent is rated “BBB” – just one grade above junk.”

This is significant considering, for instance, the debt of PG&E was investment grade until a matter of days before the giant California utility filed for bankruptcy.

Holland points to another festering financial sore,

Since the 2008 crisis there has also been a boom in so-called leveraged loans – loans to high-risk corporate borrowers – with the market doubling in size from US$550 billion to around US$1.1 trillion. And most of these loans have been repackaged and sold on to investors as “collateralized debt obligations” – just as subprime mortgages were repackaged and sold on in the 2000s.

Yes, it’s the mid-2000s all over again, think, mortgages which were gathered, bundled, sliced, diced, somehow rated AAA, and sold to unwitted investors.

Thanks to new regulations, most institutions are prohibited from holding junk bonds. Therefore,

Sooner or later, some BBB-rated borrowers will get downgraded to junk status. When that happens, ETFs and institutional investors will attempt to sell the bonds they hold – only to find few dealers willing to quote them reasonable prices.

Holland concludes his insightful piece with the endgame,

As investors take fright, US corporate bond prices will collapse. ETFs will rush to liquidate their holdings to meet redemptions, worsening the price slump. Leveraged investors such as hedge funds will face margin calls they will not be able to meet, which in turn will cast doubt on the financial integrity of the investment banks that extended them the leverage. Other banks will stop dealing with the investment banks, liquidity in the financial system will dry up, and suddenly the world will find itself facing a repeat of the September 2008 death spiral that led to the implosion of Lehman Brothers.

But for now, financial complacency, it’s EPIC!