The Hidden Housing Crisis

Here in Las Vegas the housing market has cooled, just after it had warmed from the late 2018 stall. Andrew Smith reports in the latest Home Builder Research letter that March 2019 closings were down nearly 18 percent from the same month a year ago and closings for all of 2019 are down 4.6 percent year-over-year. He says not to panic because last March was an exceptional month, the best month of the entire decade. What he leaves out is it’s been a lousy decade.

Housing analyst Keith Jurow, who also writes a column for MarketWatch, recently appeared on Real Vision saying, “There is no way I would consider buying a house either to live in or to-as an investment…” To further stress the point, he continued, “if I were a homeowner, I would seriously consider selling before things get much worse.”

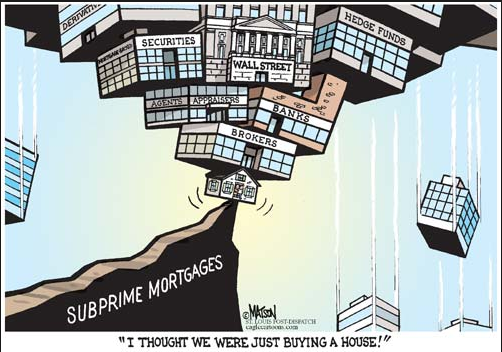

Get much worse? Most believe it’s clear sailing for housing. Jurow’s view its anything but rosy for housing. He believes the housing rebound is a mirage orchestrated by lenders and mortgage servicers keeping foreclosed homes and subprime loans in serious default off the market. In other words, there are millions of homes just waiting to hit the market. Sometime.

Jurow says,

Here's another problem that they had to deal with. During the bubble, there were some-- there was over $2 trillion of subprime mortgages that were originated. These were poorly underwritten. And they were really a disaster. Very quickly, they started defaulting in droves. And several million of them have already been foreclosed.

There are something like roughly $800 billion worth of these subprime mortgages still outstanding. And the problem is, if you take a look at this third graphic, is that-- this is a real shocker-- is that many of these subprime mortgage borrowers haven't paid a nickel in the last five years.

I’ve heard about people in Las Vegas that haven’t paid on their mortgages in years and are riding it out until the constable puts a notice of default on their door. Plus, much has been written in the local press about vacant homes in Las Vegas and the problem of squatters. However, not much has been reported in the last year.

Listening to Jurow, this is a nationwide issue.

But there was another big problem. There were so many delinquent homeowners that hadn't been put into foreclosure that they had to decide, what do we do about them? Just reducing the number of properties that you put into foreclosure wouldn't be sufficient, because new delinquencies were rising all the time.

And so, for them, the solution that they decided on was to modify their delinquent mortgages. And the shocking number is that between 2008 and 2018, some 25 million mortgages were modified. Or they had another term for things that weren't permanent modifications, they called it workouts. I won't get into that. [I wish he would]

But 25 million of them were modified, so that the servicers wouldn't have to foreclose on them. And the question is, well, did that work? Yes, in the sense that it stopped-- it prevented the mortgage servicers from having to foreclose on millions of additional mortgages. That wasn't the end of the problem, as we'll see.

One would think holders of these delinquent mortgages would be forced to write them down and thus would be motivated to foreclose and sell the properties. What Jurow implies is if mortgages were modified, the loans could stay on the books at the full amount due. This is essentially financial fraud. Bank or mortgage companies earnings are propped up through regulatory sleight of hand.. Meanwhile, some homeowners, who took out dangerous mortgages at the height of the boom and now living mortgage free.

The following graph is jaw-dropping.

Twenty-five percent of of all non-agency RMBS (Residential Mortgage Backed Security) loans in the entire U.S. are more than five years delinquent. In Nevada, the percentage is 43 percent.

Jurow continues,

You'll see that just a year ago, in some of the worst states, half of these hadn't paid a nickel in the last five years. And this problem continues. And if you take a look at the states, yes there are the usual suspects. But you'll see on the bottom that there are some states you wouldn't think that they had such a delinquent problem, but they do.

I have seen-- I have seen reports where some of these folks have not paid for seven, eight, nine years. And the servicers simply let them sit. We're talking about several million of these mortgages still outstanding.

Jurow explains that cash-out refinances exacerbated the problem When the crash came, “They were underwater and they started defaulting in droves. And that was one of the main reasons why the mortgage servicers decided, we have to modify these millions of mortgages. Otherwise, this price collapse will just continue.”

Once loans were modified, the chances of re-defaults and re-redefaults rose.

Jurow says he’s no economist and that he likes to talk in a way people can understand. True to his convictions, he writes,

And if you can picture millions of properties just sitting there-- some vacant, some not-- that haven't paid the mortgage in several years, that's the reality in many major metros, and some that aren't really major. And those who hadn't paid for five years, I picture them laughing at those people who are still paying their mortgage.

Perhaps the housing crash isn’t over after all.