Novices Chase Stocks, Gold goes Unloved

Shepard Smith, CNBC’s entry into the dinnertime news hour race, offered a segment on new investors; the over 12 million people who have opened accounts at the discount brokerages this Covid year. A 29-year old, who works in advertising, living in Georgia, is trading stocks to “pay down her student loan debt.”

A 56-year old grandmother of eight said “I went from buying part of a Bitcoin to buying my first Apple stock before it actually split.” A 30-year old small business owner in Dallas said she’s trading stocks to “create financial security.” Next came an unemployed 38-year old, filmed in front of his computer, holding his baby, trading to “support his family.”

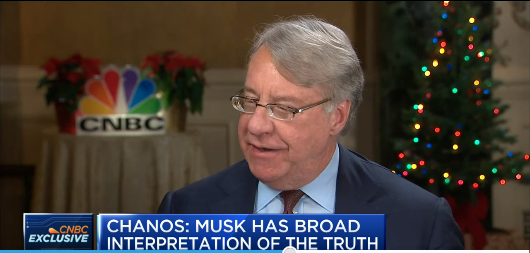

Good luck to all. They will need it. Mike Green, during his Real Vision interview with Jim Chanos, made the point, “ I actually just got off of a call with an individual who has completed a study of Robinhood investor portfolios, and the conclusion is that 98% of option related trades, despite the zero commission at Robinhood, are losing money. 98% are losing money.”

Green’s acquaintance believes what Robinhood is doing is evil. That may be a bit harsh, however, Chanos, the famous short-seller, concluded, “you are also seeing, again, a transfer of wealth from people who probably can least afford it, or do not understand what they are doing to corporate insiders and promoters. This was one of the big lessons of 1999-2000.”

Meanwhile, the ever-unloved asset, gold, goes unnoticed by the stock trading debutantes. After a sprint upward in price above $2,000, the yellow metal hangs listlessly around $1,870 these days, while the aforementioned Bitcoin is repeating a parabolic move toward $20,000.

Jared Dillian, publisher of The Daily Dirtnap, and author of a wonderful book, “Street Freak,” owns gold and is not afraid to say so. In a piece for Bloomberg he begins, “Investors don’t really have a handle on what gold is or what it represents.”

With runaway central banks worldwide, the investment landscape is as treacherous as any time in history. Yet 12 million novice stock punters are wheeling and dealing as if, well, this credit-fueled bubble will provide smooth sailing toward wealth and happiness. After all, the Federal Reserve has some 700 Ph.D. economists toiling away. Policymakers and bureaucrats have a firm grip on the wheel and a flawless GPS to see the future.

But, in case they don’t, “Gold is a hedge on policy makers screwing up, and there has been a lot of screwing up in the last 20 years,” writes Dillian. You don’t say?

It would surprise people, people who knew Tesla would become part of the S&P a long time ago, that “Gold has significantly outperformed stocks this century, gaining about 555% versus 79% for the MSCI All-Country World Index of stocks and 146% for the S&P 500 Index.”

And that was before the Oracle of Omaha, Warren Buffett, who famously said, gold “gets dug out of the ground in Africa… Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head,” bought half a billion dollars worth of Barrick Gold Corp.

Dillian reminisces that the Fed Funds Rate was 6.5% in 2000, and real interest rates (nominal rates minus inflation rate) were positive. Now, the Fed funds rate is just this side of zero and real rates are negative. Today, the Fed’s Jerome Powell, “has bought a range of risky assets in the course of pumping some $3 trillion into the financial system this year as part of its quantitative easing policy, and the U.S. budget deficit is the widest ever at $3.1 trillion,” explains Dillian, who continues, “The phrase “loose financial conditions” is a polite way of saying that the people in charge are lazy.”

Of course, the Federal Reserve, the Treasury, and Federal government policy makers might suddenly find religion, run a surplus, and pay down the government’s $20.3 trillion in debt (98.2% of GDP). But, more likely, the spending, from nowhere, will never end.

“The idea that we can print or spend our way to prosperity is very seductive,” Dillian writes. “It takes no effort. But it’s not how wealth is created.”

Compared to playing a video game or its speculative equivalent, buying partial shares on Robinhood, owning gold is dull and uneventful.

When it comes to holding on to, or building, wealth, uneventful is good.