Real Estate Still Lurks

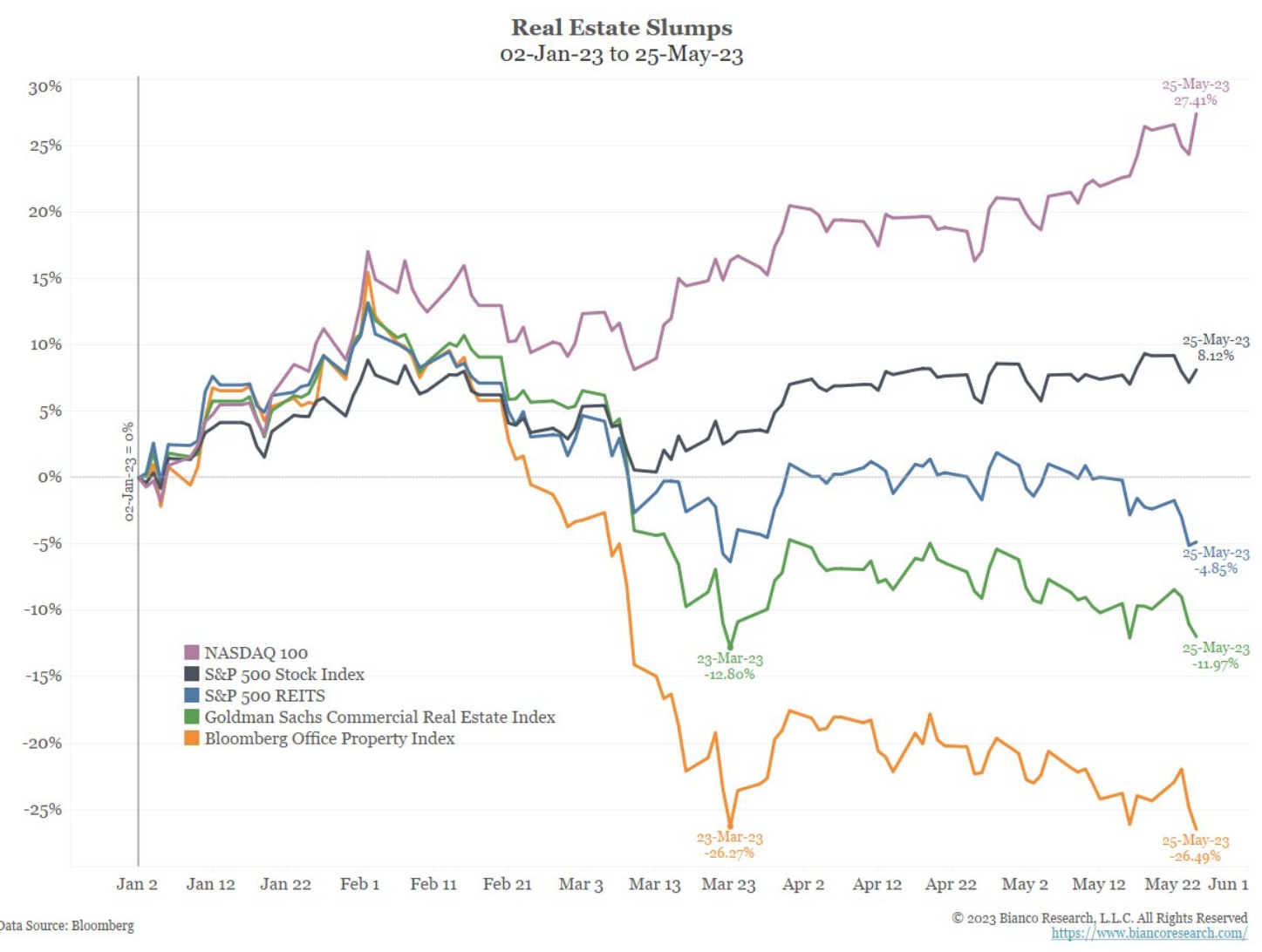

Jim Bianco tweeted a chart showing the downdraft in real estate values in comparison to technology stocks. The Goldman Sachs Commercial Real Estate index is down nearly 12 percent through May 25th, while the Bloomberg Office Property Index is down 26.5 percent from the first of the year to the 25th of May.

What happens with real estate doesn’t stay with real estate. As former Dallas Fed President Robert Kaplan said in an interview with Praxis Financial Publishing, phase two of the banking crisis was short-side investors scrutinized each bank’s loan book, focusing in particular on the loan-to-deposit ratio and the exposure to commercial real estate.

Banks can’t raise equity at this point given low valuations and tepid investor demand, so they must reduce their loan books and “find places to pull back on existing loans and future loan commitments.” PacWest Bancorp, for instance, sold $2.6 billion worth of outstanding construction loan balances for $2.4 billion, with the buyer, Kennedy-Wilson Holdings, Inc. also taking the $2.7 billion in undisbursed loan commitments. The loans carry variable rates averaging 8.4 percent.

Bloomberg reports, “Kennedy-Wilson expects to complete the purchase in multiple tranches this quarter and early in the third quarter, making a total investment of 2.5% to 5% of the purchase price and future funding obligations, it said.” It would appear Kennedy-Wilson is borrowing 95 to 97.5 percent of the portfolio purchase, presumably at less than 8.4 percent.

Last week Roc360, a real-estate lending firm, quickly closed the purchase of PacWest’s Civic Financial Services unit, which specializes in lending money to landlords and investors who buy homes to fix them up for resale.

Concerning the shrinking of loan books, Kaplan told Praxis, “It is a quiet phase that won’t make headlines but is nevertheless relentlessly going on beneath the surface.”

Kaplan explains how banks ended up in this spot. “First, we tolerated an accounting fiction. Banks were able to classify investment securities as hold-to-maturity, which allowed them to mark these securities at par even though, due to substantial increases in rates, their market values had declined to, say, 80 or 85 cents on the dollar.” That’s why PacWest and others are selling their loan books instead of bond investments.

“On a market basis, bank capital is lower than two months ago,” Kaplan said. “Most banks are now trading at a discount to book value. All of this is happening before we head into the tougher part of a credit cycle which is likely to occur as the economy weakens due to the Fed’s efforts to cool inflation.”

Short-sellers are pressing their bets against regional banks. Isabelle Lee wrote for Bloomberg on May 17th, “Short interest as a percentage of shares outstanding in the SPDR S&P Regional Banking ETF (ticker KRE) rose to 92% from 74% a week ago, according to data compiled by S3 Partners, a technology and data-analytics firm.”

Still, the regional banking meltdown “may just be pausing,” Jake Jolly, head of investment analysis at BNY Mellon Investment Management, told Lee. “Concerns around banking sector exposure to [commercial real estate] is likely one culprit underpinning the ongoing weakness and fueling bets on further downside.”