Bitcoin vs. Gold: The Debate Continues

In a few short weeks since SEC approval Inflows into Bitcoin ETF funds had reached just over $59 billion on Good Friday, according to btcetffundflow.com. Meanwhile the unloved and disrespected GLD [gold] ETF holds $54 billion, despite its thousand year pedigree.

Gold fan and crypto disser Peter Schiff debated crypto evangelist Raoul Pal on Real Vision for nearly three hours with neither combatant giving an inch. The calm Mr. Pal is the co-founder of Real Vision, a Goldman Sachs alum, and proudly says he is “irresponsibly long” Bitcoin and other cryptos. The dogmatic Schiff did numerous turns on the financial talking heads circuit post ‘08 crash and is the son of famous income tax protester Irwin Schiff.

Both agree the U.S. government has borrowed its way into disaster with the only way out being to debase the currency. Pal estimates the debasement to be 15% a year and thus if your investments and income isn’t rising by that much you are falling behind. Schiff doesn’t put a percentage on the money printing or debasement but essentially agrees. What a person is to do is where they disagree.

“People who are getting out of the dollar or the euro and buying Bitcoin have jumped out of the frying pan into the fire,” Schiff said. “I mean, so you don't have to reinvent the wheel if you want to get out of Fiat currencies, you can own gold, but you could also own other good inflation hedge assets, real assets.”

Making his case for Bitcoin, Pal said, “We've memed a trillion dollar currency into existence. We've memed it. It's just human narrative. But guess what? So's gold. So is everything that we do, including religion. Everything is a meme. So memetics rule the entire way that humans understand the world around them.”

The word Meme was coined by the British evolutionary biologist Richard Dawkins in his 1976 book The Selfish Gene, from Greek mimēma ‘that which is imitated’, on the pattern of gene. Thus, this definition is derived; “an element of a culture or system of behavior passed from one individual to another by imitation or other non-genetic means.”

So while Schiff argued for holding gold because it is a “real” asset, Pal views gold (and everything else we presume) as just a belief. Forget the yellow metal is number 79 on The Periodic Table. Forget the U.S. dollar was once represented by 1.60 g (24.75 grains) of gold. Forget as Martin Zweig wrote in the Wall Street Journal, “Adjusted for changes in the cost of living, an ounce of gold has approximately the same purchasing power it had in ancient Rome 2,000 years ago.”

He claims gold is only valuable just because humans think it’s valuable. Our forefathers thought it had value and that belief is passed on to us. Pal believes that Bitcoin’s 14 years of existence give it the same qualities and will not fall victim to to what the economist Joseph Schumpeter called “the perennial gale of creative destruction.”

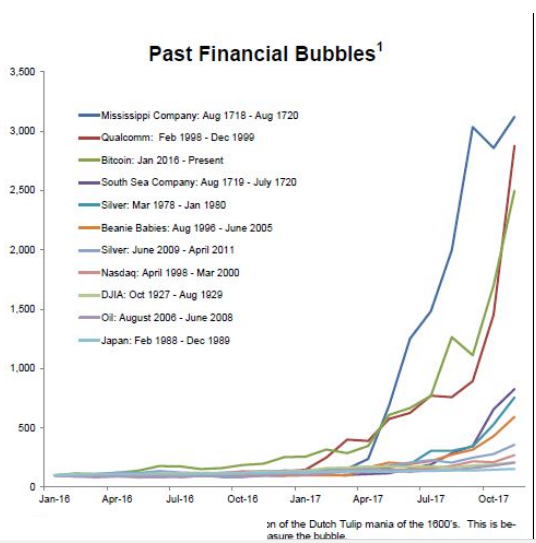

Schiff countered that Bitcoin has a price, but has no value. The fact a Bitcoin has gone from less than a $1 to $70,000 makes it no better than tulip bulbs in 17th century Amsterdam or Beanie Babies in the mid-1990’s. Bitcoin is merely a vehicle for speculation.

Schiff’s contention that buyers of Bitcoin are “stupid” and its price will go to zero annoyed Mr. Pal. In turn, Mr. Pal’s contention that Bitcoin is the greatest performing financial asset of all time rankled Schiff.

“Peter, it's been around 14 years,” an exasperated Pal argued. “We've gone through four cycles where it's gone down 90% and it still is the best performing asset. So your, ‘Oh my God scenario goes down 90% [is no big deal].’ I've gone through three of those myself.”

The ex-hedge fund manager who retired at 36 makes 14 years sound like forever. For folks my age 14 years ago seems like yesterday. Pal’s continued emphasis on Bitcoin’s 14 year existence makes Schiff’s argument better than Schiff himself did.

“Obviously we don't need these ETFs. That's just the manufacturer to try to pump up demand. But yes, it's easy to store your Bitcoin relative to gold, but the difference is when you're storing gold, you're storing something. And so since you have something, it takes some effort to store it,” Schiff said

“When you're storing Bitcoin, you're storing nothing. So what good is the fact that it's easy to store nothing? Yes, I've got a very safe, secure supply of nothing and Bitcoin though, as long as people think it's going to go up, as long as they maintain that delusion and more people want to buy it, sure, it will have a price. And if enough people don't sell it, then some people can, right?”

Pal responded that that was the case with all investments. To which, Schiff excitedly shouted, “No it’s not. No it’s not. Gold is an actual commodity that’s used.”

Pal poo-pooed this argument claiming just a small percentage of gold is actually used. He dismissed jewelry use. Which Schiff countered with, “But they’re not wearing their Bitcoin.” Schiff mentioned gold’s use as a conductor of electricity. He might have roused Pal’s attention with “gold is utilized to mount processing chips onto motherboards” of computers.

Launching again into attack mode Schiff said, “But eventually the story blows up. You know, people stop believing in the fairy tale. You know, you talk about all these young kids that think they've reinvented the wheel and think that they know more than their parents or their grandparents. You know, it's like, look, you know, little kids believe in all sorts of things.

They believe in the tooth fairy. They believe in the Easter Bunny and Santa Claus, you know, but they don't believe in these things for their whole lives. As they get older, they start to see the truth. And I think the same thing is going to happen with Bitcoin. People are going to grow up and they're going to learn from the mistakes of their youth.”

At the end of the Jimmy Carter presidency the Gold Commision was approved and was formed early in the Reagan Administration. The commission was packed with anti-gold types with Ron Paul carrying the torch for the minority. Paul had Murray Rothbard ghost write the minority report with Paul and businessman Lew Lehrman signing as authors.

In Lehrman’s new autobiography The Sum of It All, Lehrman distances himself from the report. However, he writes “It’s probably the single greatest secret in the history of modern monetary policy,” that after the report was released the Paul Volcker Fed “followed a gold price rule for quite a while. This, of all things, is where we got both the defeat of the horrible stagflation of the previous dozen years and the mega-boom of the 1980s and 1990s.”

Paul has mentioned in many speeches visiting Volcker in his office and the Fed Chair constantly wanting to know what the price of gold was doing. To that point, Lehrman writes, “the Fed’s top men set to watching the price of gold like a hawk for two decades.”

We don’t know whether Fed Chair Powell is watching the price of gold or Bitcoin. What we know is the value of the U.S. dollar continues to decline.

The late, great Burt Blumert once told me, “Always take possession of your gold.” Still good advice.

To protect your wealth from the government printing press click here.