My reflections on a certain real estate bubble and how it seemed similar to his acute certainty of how the future would progress made no dent in his enthusiasm.

All in Economics

Big Apple Cabbies and Credit Unions Suffer, while Big Money Circles

A medallion being essentially a license to drive a cab, $150,000 to $450,000 doesn’t seem like the bottom, however at the peak. 2014, a medallion went for $1.3 million. By the way, Uber was founded in 2009, but New York cab owners either didn’t get the memo, or didn't understand the implications.

Legalization Creates Violence and Product Shortages

Pot is available everywhere and only when government gets in the way does supply become a problem. The California growers association worries, as Thomas Fuller writes, “there may not be enough regulated marijuana to serve the legalized market, a highly paradoxical situation in a state that is by far the largest cannabis producer.”

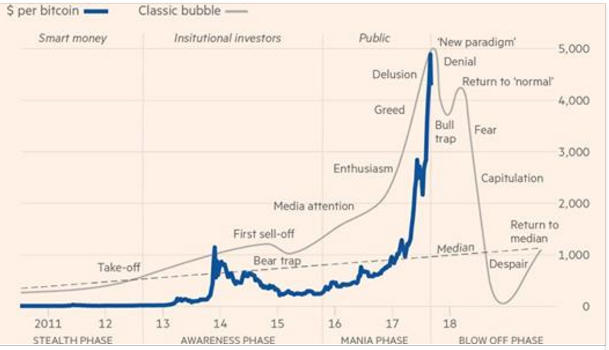

Hell Hath No Fury Like a Crypto-Bubble Denier Scorned

Crypto fans might wonder what the “craft” refers to. Grant’s believes the burgeoning digital currencies have more in common with craft beers and government fiat currencies than Krugerrands, Eagles and the golden like.

Business Rebel Plays the Austrian Business Cycle (and wins)

Zell explains that entrepreneurs think differently. “It’s about how you perceive the world,” he writes. “Entrepreneurs are the ones who are always looking for opportunities to do things better. They don’t just recognize problems; they see solutions.”

What Could Go Wrong: Flight Attendants & Chimney-sweeps

The Elliott Wave folks remind us, “It’s always like this in the end. The easy way becomes the obvious way. In this case, all a person has to do is push a button and literally create money. What could go wrong?”

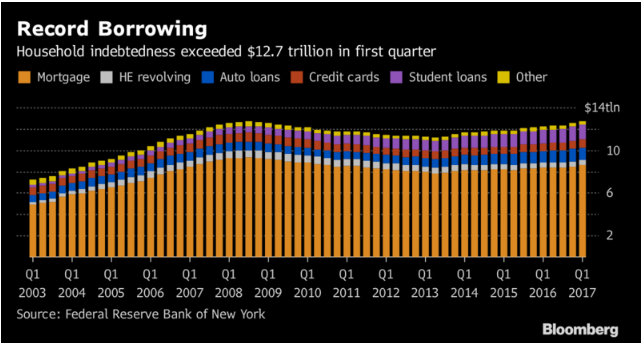

Meet the New Nonprime, Same as the Old Subprime

there's nothing shady or menacing about the business of subprime. On the contrary, they say, specialist lenders in this area are performing a vital service for the world's largest economy

Real Estate: the investment the common people know they want and deserve to get good and hard.

But there’s one big reason why the rich still come out ahead -- instead of stocks, the middle class puts a large share of its wealth into residential real estate. Houses tend to earn lower returns than stocks.

Vultures Wait for the Cluster of Errors

The big monied real estate players know this real estate boom is long in the tooth and are raising money to buy up the distressed pieces when the time comes.

Americans Back to Borrowing a Lifestyle

Wages aren’t going anywhere so, “For most Americans, whose median household income, adjusted for inflation, is lower than it was at its peak in 1999, borrowing has been the answer to maintaining their standard of living,” Golle writes.

Fed Policy: Conundrums and High Priced Junk

“Because asset prices aren’t part of official inflation measures, and because identifying an asset bubble is beyond their scope, central bankers eschew using monetary policy to respond to them.”

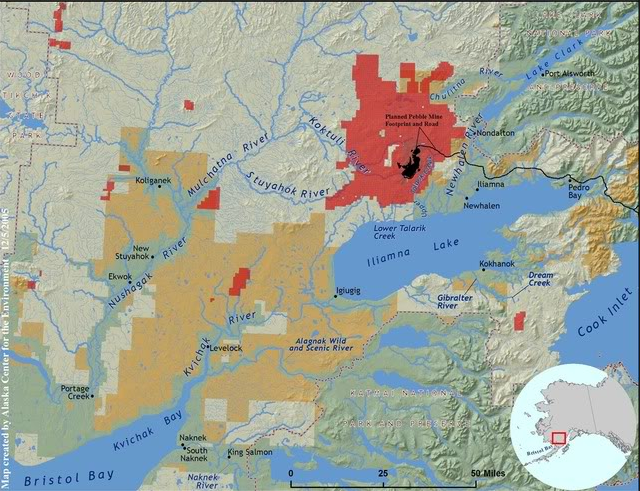

The Politics of Mining

The big three miners have cut their collective debt in half from 2014 and now the question is what do they do? “The question for investors is whether miners will continue to pay down debt—and boost dividends—or, lured by rising commodity prices, return to the big-spending ways that got them into trouble two years ago,” writes Patterson.

Dalio Says Get Yourself Some Gold

Here we are a few months later and Dalio says, batten down the hatches. “As a rule, periods of lower risk/volatility tend to lead to periods of greater risk/volatility.”

Preposterous Bubble Predictions and the Madness of Crowds

While I have friends claiming to be made wealthy in the cryptocurrency boom, it all sounds like the same old mania chatter, whether it be tulips, stocks, bonds, houses or Beanie Babies.

Currency Creation: Old and New

So while socialism has turbocharged the drain of capital and societal deterioration in Venezuela, Protocol Labs Inc. raised about $193 million for its Filecoin Network.

Monetary Policy: A Nut Here, a Crouton There

“Federal Reserve policymakers appeared increasingly wary about recent weak inflation and some called for halting interest rate hikes until it was clear the trend was transitory, according to the minutes of the U.S. central bank's last policy meeting.”

Schianto in Italiano Means Crash

The ECB gets its money to buy assets the same way the Fed, or any central bank, does--out of thin air. If government bonds are in short supply, central banks can always follow the Bank of Japan’s lead, buying ETFs in addition to corporate and sovereign bonds.

Trump and Yellen Make for a Volatile Pair

The Trump rally, as John Hussman wrote on August 7, has pushed the market to “the median price/revenue ratio of S&P 500 component stocks reached the highest level in history, advancing far beyond the levels reached at both the 2000 and 2007 market peaks.”

Elon Musk Preys on Short Memories

“It’s a well-oiled routine,” Bloomberg reports. “Musk previously tapped his cult-like followers in the equity market for capital eight times in seven years to fund Tesla’s growth. Apparently, his pitch works on debt investors, too.”

Get Lost Norma Rae

There will be no movies made of last week’s union vote at the Canton, Mississippi Nissan assembly plant. Representatives of Nissan Motor Co. and the United Auto Workers union said late Friday that 2,244 workers, or 62 percent, voted against the UAW, while only 1,307, or 38 percent, favored the union. This was the first union vote at a Mississippi plant.