“We’re in a mental recession,” chief economist at Freddie Mac Sam Khater told the Journal (presumably with a straight face). “It’s a constant stream of negative headlines for a couple of months…it wears on you.”

All in Las Vegas Market

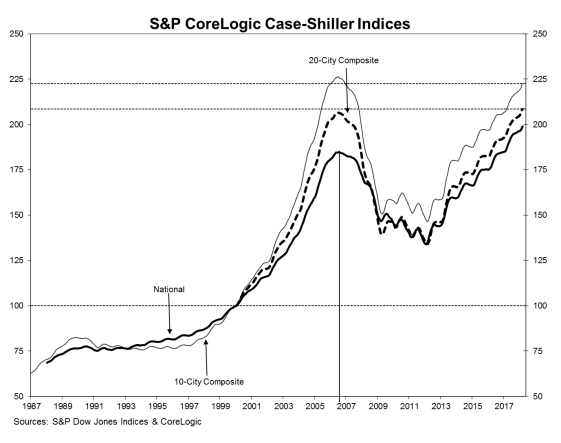

Housing Affordability Down, Inventory Up

For those believing this is the pause that refreshes, James Stack thinks otherwise. “Housing could be heading for its worst year since the last housing crash," Stack, 67, said told Bloomberg in a phone interview. “Expect home sales to continue on a downward trend in the next 12-plus months. And there’s a significant downside risk to housing prices if a recession takes hold.”

Can Raiders Arrive Fast Enough to Save Housing Market?

Vegas was the hottest market in country two months ago, now, not so much. But home sellers are telling their realtors to check the paper for the business section headline, “Las Vegas home prices rising fastest in country, still.” Those kind of headlines have sellers listing their properties for $20,000 to $40,000 too much, realtors tell me.

Low CAPs, Clear Crystal Balls

Can rental rates keep climbing? Will interest rates remain low forever? Griffin Capital seems to think the answer to both questions is ’yes’.

California Housing Funk Crosses Boarder to Nevada

With California being Nevada’s primary feeder market, what happens in California won't stay there, but migrate to Nevada.

Irrational Apartment Exuberance

Those “high rents” I referred to are now commonplace around the Las Vegas valley. I toured a project recently, located far from the strip, but with all the bells-and-whistles the Lotus has, and the owner told me he is earning $1.80/sf a month. He told me his project wasn’t for sale. We’ll see.

Can Vegas Ever Build Too Much Convention Space?

Is it possible, Las Vegas, which already has more exhibition space, by many multiples, than any other U.S. city, might build too much convention space? That more space won’t automatically turn into more heads in beds at premium prices?

Housing Top is In

The interest rate which most influences mortgages is the 10 yr treasury which has increased nearly 200 basis points since it’s bottom in the summer of 2016. The latest 30-year mortgage rate per investing.com is now at 5.05% a huge jump from the 3.6% two years ago.

Housing: Rates Up, Demand Down

However, homebuyer mood has changed. Be it increased interest rates or Trump’s Tweets & Tariffs show, I’m told by those selling homes that buyers that were bullish with a capital B, a couple months ago. are now, not so much.

Las Vegas: How Long can the Expensive Drunk Last?

Las Vegas hotels are more in the space renting business than the games of chance business. Want a place to sit while you tan at Encore? Ms. Bond writes, “Prices can range from $5,000-ish for a daybed to $10,000 for a “water couch,” a 10-person table-sofa-lounge combo situated in a shallow part of the pool.”

Vegas's Greatest Week?

It used to be that the only stick men that mattered were at the city’s craps tables pushing dice and barking “new shooter coming out.” A hockey puck was what Don Rickles called the dim witted. Now the town is cuckoo for hockey as the Golden Knights skate against Washington D.C.’s Capitals for the Stanley Cup.

Las Vegas: Prices Increase for Housing and Parking

Despite a shortage of labor, builders have pulled over 4,000 permits for new home construction through this year’s first four months a 33 percent increase from a year ago. Andrew and Dennis Smith ominously write, “This also marks the first time since 2007 that we have reported more than 1,000 permits pulled in two consecutive months.”

Malamud Retires, Remembering Rothbard

Imagine how different the History of Thought class was with Rothbard (his 2 volume “An Austrian Perspective on the History of Economic Thought” was essentially his lectures) as opposed to Malamud’s version.

Sideways Skyscraper Curse

What those of us in Vegas are wondering (h.t. Jeff Barr); wouldn’t the skyscraper curse apply to large scale public works projects? The improvements are horizontal instead of vertical, but what happens at the end of massive highway infrastructure projects like the ones continuing in Las Vegas.

The New American Way: Get High and Shop Online

This is a new segment of the industrial real estate market that is being created in front of our eyes,” George M. Stone, a longtime real estate executive now focused on the pot business told Gelles. “It’s a huge industry and only getting bigger.”

Little Inventory, Plenty of Squatters

What Tina and Smith don’t mention Eli Segall does in the Las Vegas Review-Journal,”Some 2.17 percent of homes in the Las Vegas area, or a total of 14,334 properties, are vacant

What has Homebuilders so Confident?

Here in the west, sentiment is a smoking 77. In the South, 68, and in the Northeast sentiment rose one point to 50. In the midwest, 63 is the number.

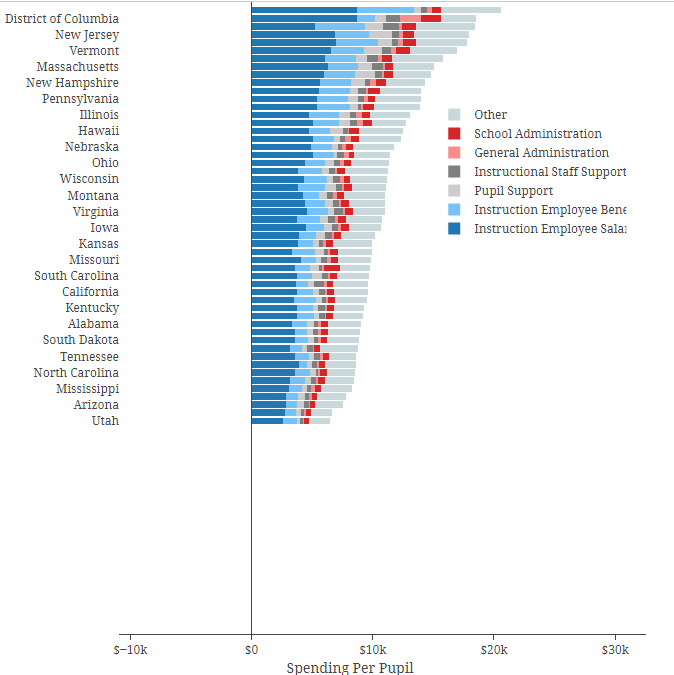

Does K-12 funding=High ACT Scores?

Out west, Alaska and Wyoming spend a ton on k-12 (over $15,000/student/year) and only have scores of 19.8 and 20.2, respectively to show for it. Utah and Idaho spend less than half what Alaska and Wyoming spend and have higher scores.

Icahn's Perfect Timing

Icahn didn’t put a lot of thought into the purchase back in 2010, “according to a former listing broker for the hotel, Icahn bought it sight unseen and didn’t know what he’d do with it,” writes Eli Segall of the Las Vegas Review Journal.

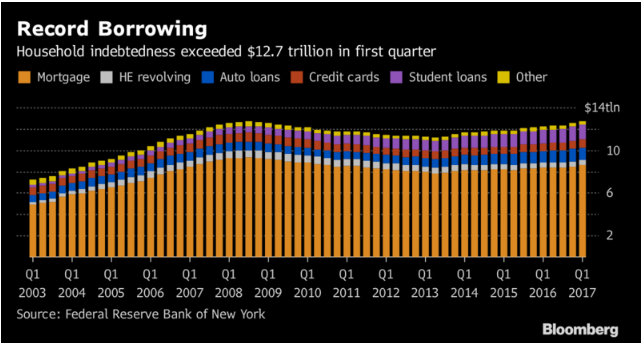

Americans Back to Borrowing a Lifestyle

Wages aren’t going anywhere so, “For most Americans, whose median household income, adjusted for inflation, is lower than it was at its peak in 1999, borrowing has been the answer to maintaining their standard of living,” Golle writes.