“Abolish social housing, scrap prescriptive planning regulations and usher in the wholesale privatisation of our streets, squares and parks,” wrote Oliver Wainwright who was paraphrasing comments made by Patrik Schumacher shocking his architect colleagues in Berlin. Suddenly, Schumacher became “the Trump of architecture."

All in Book Review

Business Rebel Plays the Austrian Business Cycle (and wins)

Zell explains that entrepreneurs think differently. “It’s about how you perceive the world,” he writes. “Entrepreneurs are the ones who are always looking for opportunities to do things better. They don’t just recognize problems; they see solutions.”

The Boy Plunger: Triumph and Tragedy

If he were alive today, the great Jesse Livermore would, no doubt, be preparing as he did in 1929--to make a killing.

Ravens Discovered to have Low Time Preferences

“ravens anticipate the nature, time, and location of a future event based on previous experiences. The ravens' behavior is not merely prospective, anticipating future states; rather, they flexibly apply future planning in behaviors not typically seen in the wild.”

America's Troubles: The Boomers or Democracy?

"There is something wrong with the Boomers and there has been for a long time,” writes Gibney in the forward to A Generation of Sociopaths: How the Baby Boomers Betrayed America and the author’s beatings continue for 400 plus pages.

The Cake, the Rain, and Positive Mood

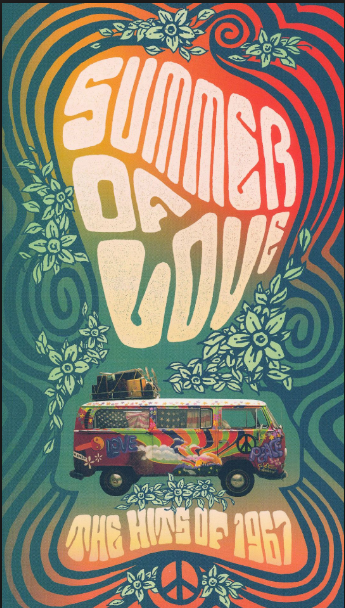

Jimmy Webb, writes in his new book The Cake and the Rain, “My imagination soared under the influence of these Beatles (and “world class LSD”). Sgt. Pepper was nothing less than a heroic album. It was as important as any music ever written.”

Extraordinary Cuddly Delusions and the Madness of Crowds

Easy money and the allure of certain riches have trapped speculators for centuries. A bubble that is easy to see in hindsight seduces the imagination while in progress, whether the trading is in tulips or teddy bears.

Rickards emphasizes that economic order emerges spontaneously from economic complexity instead of being imposed by central bankers and their policies. So what we have now with central bank central planning is disorder and continuous malinvestment.

The Independent Institute’s Boom and Bust Banking: The Causes and Cures of the Great Recession features multiple authors but puts the blame for the crisis with one institution–the Federal Reserve.

The shy undertaker was not a swashbuckling Randian hero or libertarian firebrand, but a passive-aggressive political manipulator.

It's exhilarating to read about working people who do their job better than anyone in the world. These people will never be wealthy or famous, but every day they do a job faster and better than anyone. Bourdain introduces readers to one of these gifted and productive people, in the kitchen at New York City's premier fish restaurant, Le Bernardin.

"If there is such a thing as dog-eat-dog capitalism, this must be it — with customers holding the leash."

If not for metaphors I doubt I could understand much of the modern world. So much of what it takes to produce what you're looking at right now I can't begin to fathom. But this lack of knowledge doesn't absolve me from making decisions involving this modern technology.

The author draws from a variety of disciplines in his quest to understand booms and crashes, spending the first part of the book explaining the lenses that he uses to examine these events. He disposes of the efficient-market hypothesis in his microeconomic lens and instead opts for George Soros's theory of reflexivity.

Thankfully, the Yale instructor is clearer in his writing than Mr. Soros. Instead of higher prices meaning lower demand and lower prices increasing demand thus leading to equilibrium and efficient markets, reflexivity takes into account human behavior.

In Triumph of the City, Glaeser makes the comment that he has "a taste for free markets," but anyone interested in his book should know going in that the author's free-market palate is slight; and the author's blind spot for markets and soft spot for government monopolies keeps an interesting book from being a great one.

Paterson was not just adventurous with her words — calling Eleanor Roosevelt "a pathetic fool" for instance — but the first time she flew, November 5, 1912, she set a record for reaching an altitude of 5,000 feet, flying higher than any woman had to that point. The 26-year old Canadian frontier girl sat beside pilot Harry Bingham Brown in the tiny Wright biplane, constructed of cloth and wood and said afterward, "It was the greatest experience of my life."

In Utah, she attended school but a month before asking to leave. She knew more than the teacher and at seven years old she was already reading "a consideration of Bryan's stand on the free silver question." So readings the teacher offered, like the Little Red Hen, provided no stimulation.

You always remember books that change your mind, because these books are so few and far between. We're drawn to books that reinforce what we already believe. It makes us feel smarter that an author shares our opinion and provides words we can use to make our case on the off chance that's required.

Hyman's most enlightening chapter is entitled "Securing Debt." After decades of urging the American public to borrow and banks to lend, in the 1960s the government planted the securitization seed that would grow to tip the financial system over in 2008. LBJ's Great Society looked to push capital into decaying cities, but the buying and selling of individual mortgages was cumbersome. Mortgage paper needed to be bondlike, and the Housing Act of 1968 implemented this vision, remaking "the American mortgage system in a way that had not been done since the New Deal."

The big picture is that governments inevitably reduce the value of their currencies to their intrinsic value. But in the meantime, politicians are looking for votes, and governments look for advantage over competing governments. It is not just rockets and bombs that are fired; war is raged on the economic front, with currency manipulation as the primary weapon. It is this brutal economic warfare that is the subject of James Rickards's outstanding new book, Currency Wars: The Making of the Next Global Crisis.

Fans of financial TV will recognize Rickards as a fast-talking, straight-shooting pundit on banking and the macro economy who actually talks seriously about the world returning to some form of gold standard. In fact, in Currency Wars, he lays out a plan to return to gold and sees it as the only way the financial world can avoid collapsing into total economic chaos.

But before he gets there, Rickards gets the reader's pulse surging with the warning of a complete collapse in the book's preface, telling readers that Fed chair Ben Bernanke "is engaged in the greatest gamble in the history of finance."

Dillian tells his story in a fast-paced style that sweeps the reader up into the author's two worlds: the bare-knuckle world of price discovery on the trading floor, along with his descent into depression and the constant coping with his nearly debilitating obsessive-compulsive behavior. All of this makes the book hard to put down.

Street Freak is a great American success story — with a twist. A young man gets out of the Coast Guard and dreams of having a Wall Street career, working in the center of capitalism — the World Trade Center. But he doesn't have the top-tier college pedigree that paves the way to the brass ring. The competition is fierce in the Lehman Brothers training class. He has a slim chance of earning a position.

His training is rudely interrupted by 9/11 and the author must live with the memory of watching the second plane ram into the second tower right above him.

Levitt and Dubner name their chapters provocatively to reel the reader in: for instance, Chapter 1 is entitled, "What Do Schoolteachers and Sumo Wrestlers Have in Common?"

Levitt and Dubner spend a quarter of the book on parenting and kids. The authors come to some interesting conclusions about what really matters in parenting. Kids tend to get higher test scores if their parents are highly educated: because these parents have higher IQs and IQ is strongly hereditary. Children of mothers over thirty tend to do better in school. These women tend to be better educated or career oriented. Children whose parents speak English at home have better test scores. Conversely, adopted children do worse on tests, because adopted kids are most influenced by their biological parents' IQs; that are likely low. Reading to children doesn't improve test scores. However, children growing up in a house full of books do well in testing. Lots of books, mean high IQ parents.

The final chapter on naming children is the most fun. What's in a name? Nothing really. But, the speed at which children's names change and why is interesting and funny.

Freakonomics has been criticized for its controversial content, its lack of scholarly rigor, trivial subject matter and conclusions, and failure to expose the real economic damage done by government regulations and government granted monopolies. But, despite the flaws, I'm happy that a book of this subject matter is a bestseller.