Housing: Distorted and Unhealthy

Home prices are increasing and Lennar Homes has devised a way for student loan-strapped millennials to borrow their way to the American Dream--homeownership! Laura Kusisto writes for the Wall Street Journal,

A subsidiary called Eagle Home Mortgage plans to introduce on Tuesday a program under which Miami-based Lennar will pay off a significant chunk of the student loan of a borrower who purchases a home from them.

Other builders will likely follow, “which could help lure more of the critical first-time-buyer segment into home purchases.”

When millennial buyers purchase from Lennar, Eagle will make a payment to a buyer’s student loans of as much as 3% of the home’s purchase price, up to $13,000 and reportedly, “The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

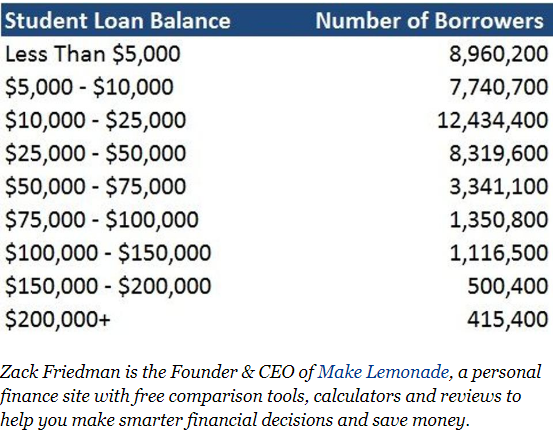

There are more than 44 million borrowers with $1.3 trillion in student loan debt in the U.S., with the average student in the Class of 2016 having $37,172 in student loan debt. However, nearly 40 million of those borrowers owe $25,000 or less. So, Lennar’s program will entice plenty of home buyers.

For instance, Ms. Kusisto writes about a couple in their mid-30’s, Christopher Oquendo and Jeri Coate, who are planning to use the program to virtually payoff their student loans. Oquendo and Coate were jonesing for bigger digs but were reluctant to take on more debt. Thankfully, the clever folks at Lennar came to the rescue, as Ms. Coate, who works in a notary’s office, still had outstanding student loans from training she had done to be a medical administrative assistant.

Some may remember that Lennar partnered with the FDIC forming an entity called Rialto to buy up busted real estate loans for pennies on the dollar from failed banks after the crash of 2008. By all accounts, Rialto was ruthless with borrowers. In 2012 Daniel Malloy wrote from the Atlanta Journal Constitution,

At a U.S. House hearing, Scott Leventhal of Tivoli Properties and Republican Rep. Lynn Westmoreland, among others, accused the Federal Deposit Insurance Corporation of allowing companies to shake down borrowers. They also said the FDIC gave Rialto Capital Management and other companies sweetheart deals through the FDIC’s structured transition program.

Now Lennar is looking to do Uncle Sam a solid by paying off some outstanding student debt, which was at least 10 percent delinquent at the beginning of the year. The true delinquency rate for student loans is likely higher because many student loans are in grace periods.

Some people are skeptical of Lennar’s program. “This is not without risk,” said Jonathan Lawless, vice president of customer solutions at Fannie Mae. “Builders always want to provide more money and incentives for people to buy their homes. It has the potential to start distorting values.”

Mr. Lawless believes making credit more available to millennials might end up exacerbating the shortage of homes if Fannie and others also can’t come up with more ways to give builders incentives to build more starter homes.

It is as Lisa Casanova wrote for Mises.org back in 2006,

government interventions in the economy are like bacteria: you only need to start with one, and before long, you have another, and another, and another, until there are more than you can count (though there are limits on how much bacteria can reproduce themselves. I see no such limits with government).

The housing and lending markets are among the most distorted by government intervention. By bailing out Fannie, Freddie and the big banks, not to mention crony capitalism like the Lennar/FDIC Rialto partnership, the housing and debt markets were never allowed to crash and cleanse in a properly capitalistic way.

Diana Olick, CNBC’s real estate cheerleader, admits,

the nation's housing market is assuredly unhealthy; in fact, it is increasingly mismatched with today's buyers. While the big numbers don't lie, they don't tell the real truth about the affordability and availability of U.S. housing for the bulk of would-be buyers.

While sales are falling, prices are nearly 6 percent higher than a year ago, nationally. Some local markets are even seeing double-digit annual price gains. There is a severe lack of supply for affordable homes, where the most demand exists. Thus, lower-priced homes are jumping in price because of competition, while prices for high-end homes are flat.

"It sets up a situation in which the housing market looks largely healthy from a 50,000-foot view, but on the ground, the situation is much different, especially for younger, first-time buyers and/or buyers of more modest means," wrote Svenja Gudell, chief economist at Zillow in a response to the latest home-price data. "Supply is low in general, but half of what is available to buy is priced in the top one-third of the market."

Murray Rothbard explained in Man, Economy and State,

With intervention, one group gains directly at the expense of another, and therefore social utility is not maximized or even increased; there is no mechanism for speedy translation of anticipation into fruition, but indeed the opposite ... the indirect consequences of intervention will cause many interveners themselves to lose utility ex post.

Homebuyers beware: the distorted housing market is, and will continue to be, unhealthy.