Bitcoin: Zero to Infinity

John McLaughlin, host of The McLaughlin Group, would pose questions to his panelists asking for a numerical prediction of the possibility of some political occurrence happening, as follows, “From Zero to Ten, with zero being zero metaphysical chance of occurring and Ten meaning Metaphysical Certitude.” No one would get the right answer, if by chance the host gave them a chance to respond, ala Dana Carvey as McLaughlin on Saturday Night Live.

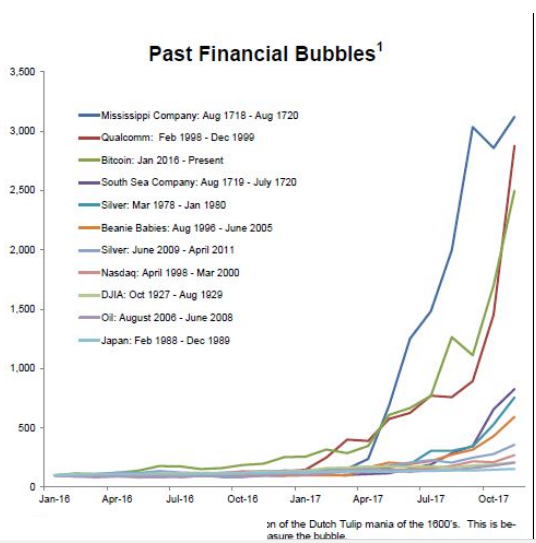

So, what does the McLaughlin Group, the real thing led by the late John McLaughlin or SNL’s led by Carvey, have to do with the price of...well..Bitcoin. It just so happens to be the extraordinary massive spread between what the cryptocurrency’s price could fall to...zero, and how high the creme de la creme of crypto coin could go to….infinity!

Yes, that’s right. Kraken CEO Jesse Powell told Bloomberg, when asked how high the price of Bitcoin could go, said, with a straight face, “We can only speculate, but when you measure it in terms of dollars, you have to think it’s going to infinity,” he said. “The true believers will tell you that it’s going all the way to the moon, to Mars and eventually, will be the world’s currency.”

At the same time Aton Wahlman wrote for Seeking Alpha, with a brief mention of Murray Rothbard and Ludwig von Mises, “I don’t know when crypto/Bitcoin will fall to their intrinsic value of $0, but I do predict that they will - someday, when the crowd suddenly sees that The Emperor has no clothes.”

The Kraken headman says anything now priced in dollars, euros, or yen, will soon be priced in Bitcoin. “Powell said Bitcoin could reach $1 million in the next decade, adding that supporters say it could eventually replace all of the major fiat currencies.”

In a curious quote Powell said the dollar “is only 50 years old and it’s already showing extreme signs of weakness, and I think people will start measuring the price of things in terms of Bitcoin.” I guess we should assume he would be referring to the completely unbacked Nixon dollar of 1971.

Bloomberg’s Lyn Thomasson writes, “Strategists at one of the world’s largest wealth managers are issuing a warning to newbie crypto investors plunging into the record rally: You could still lose all your money.”

“There is little in our view to stop a cryptocurrency’s price from going to zero when a better designed version is launched or if regulatory changes stifle sentiment,” authors including Michael Bolliger, the chief investment officer for global emerging markets, said in a report. “Netscape and Myspace are examples of network applications that enjoyed widespread popularity but eventually disappeared,” the strategists wrote in response to rising client interest.

Meanwhile, Scott Minerd of Guggenheim Investments told Bloomberg that Bitcoin could be worth about $400,000 [per coin], while JPMorgan Chase & Co. strategists see a case for $146,000 in the long run. Also, some famed investors like Paul Tudor Jones and Stan Druckenmiller are entering the industry to gain profits, while critics only see gambling, scandal and manipulation.

The two older gentlemen who make investment decisions for Berkshire Hathaway, Warren Buffett and Charlie Munger, call cryptocurrency, "rat poison squared," a "mirage," and a "gambling device" in Buffett’s words while his partner Munger calls Bitcoin "just dementia" and compared it to "trading turds."

Bye. Bye.