Retail Investors Positioned For Thrashing

Retail stock traders are always the last to get the memo. “One group that’s been buying relentlessly is retail traders,” write Barry Lipshultz and Jean-Patrick Barnett for Bloomberg. “Individual investors purchased a net $32 billion in US shares and exchange-traded funds over the 21 sessions through Thursday, a record for such a span, Vanda Research data show.”

Individual investors are fighting the Fed trading options that expire the same day they begin trading. “This week, volume for contracts that expire on the same day they’re traded hit a record 50% share of all the options transactions on the S&P 500, data from CBOE and Nomura show.”

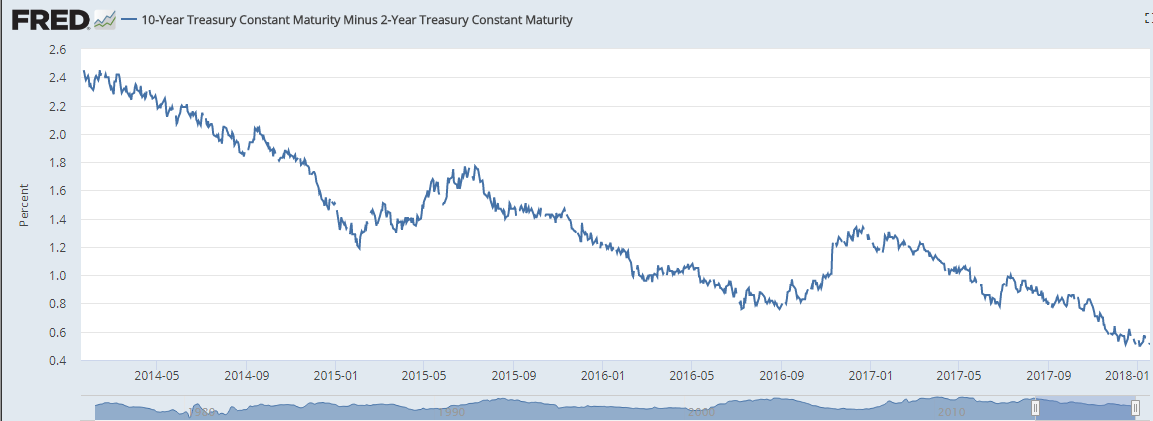

JPMorgan Chase & Co.’s Marko Kolanovic, for one, sees a “prevailing sentiment of exuberance and greed.” All this in the face of 6-month U.S. Treasuries yielding 5 percent, the first time since 2007. And, the 2-10 yield curve inversion being greater than in 2006. Yield curve inversions have predicted 8 out of the last 8 recessions.

Corporate earnings are going the wrong way. “Profit growth has turned negative on a year-over-year basis, which has happened just four other times in the past two decades and has never been an encouraging sign for stocks.”

Credit card balances hit an all-time high in December and “mortgage balances in Q4 rose 2.2%, or by $253 billion, from the prior quarter, and by 9%, or by $1 trillion, from a year earlier, even as home sales volume plunged by 34% in Q4. Mortgage balances now reached $11.9 trillion,” reports Wolf Richter on WolfStreet.com.

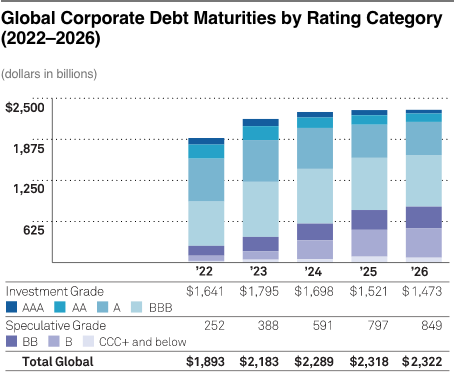

Corporate debt maturities are $2.1 trillion this year and $2.3 trillion for each of the next three years. This debt will have to be rolled at much higher rates, if the debt can be renewed at all. Look for a spike in corporate bankruptcies. A look at the graph shows the tiny amount of AAA bonds that are coming due. The majority is BBB and below. If the Federal Reserve is looking to create a train wreck, this is where it will be.

Meanwhile, “The upshot is that fear of missing out (FOMO) has made a comeback,” said Ed Clissold, chief US strategist at Ned Davis Research Inc. “Even some investors who doubt the Fed can engineer a soft landing have begrudgingly gotten on board.”

In a slender volume entitled, A Short History of Financial Euphoria, John Kenneth Galbraith wrote, “But the errors of vanity of those who think they will beat the speculative game are also thus reinforced. As long as they are in, they have a strong pecuniary commitment to belief in the unique personal intelligence that tells them there will be yet more.”

Some lessons must be learned over and over.