Meanwhile, Warren Buffett is betting humans will be driving trucks for a long time to come. He bought 38.6% of Knoxville, Tenn.-based family-owned Pilot Travel Centers LLC. Pilot Flying J and plans to boost ownership to 80 percent in 2023.

All in Economics

Gold-backed Yuan and the Cryptos spell trouble for the Dollar

Not bitcoin backed, not ethereum backed, g-o-l-d backed. How low tech of the Chinese. For the moment, oil is priced in dollars, whether it’s Brent or West Texas Intermediate.

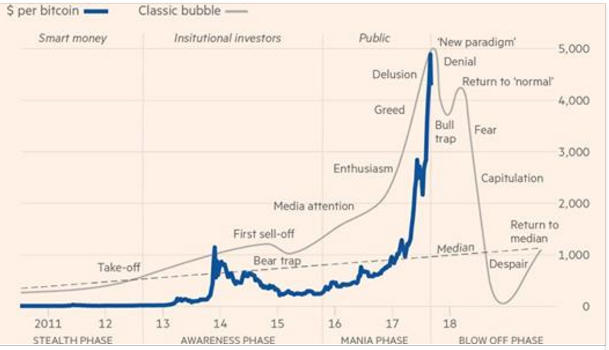

My Bitcoin: Lost Forever on the Blockchain

That was October 5, 2013. The following Monday bitcoin traded for $125.94. My lost crypto was no big deal then. Now, trading over $4,000 per coin. Much bigger deal. It turns out I’m just one of many to lose my coin.

Rocket Man Musk's Fantasy Land

Musk has never met a timeline he hasn’t blown, whether it's making cares, rockets or solar panels.

Politically Incorrect Architecture

“Abolish social housing, scrap prescriptive planning regulations and usher in the wholesale privatisation of our streets, squares and parks,” wrote Oliver Wainwright who was paraphrasing comments made by Patrik Schumacher shocking his architect colleagues in Berlin. Suddenly, Schumacher became “the Trump of architecture."

Housing: Distorted and Unhealthy

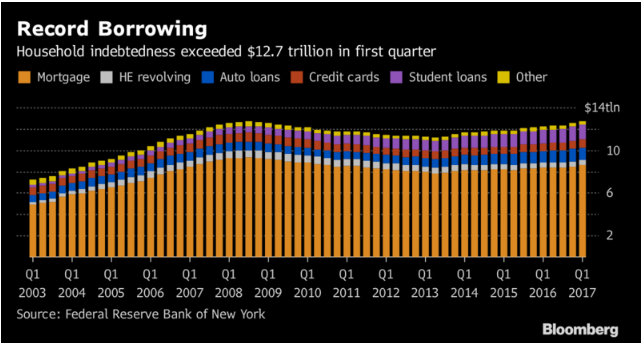

The housing and lending markets are among the most distorted by government intervention. By bailing out Fannie, Freddie and the big banks, not to mention crony capitalism like the Lennar/FDIC Rialto partnership, the housing and debt markets were never allowed to crash and cleanse in a properly capitalistic way.

Meredith's Prophecy: Gradually, Not All at Once

“She underestimated the glacial pace that these events take place at. She misunderstood the leeway that a local government or state is allowed based solely on past performance and presumed credibility. Most importantly she misunderstood the lengths that elected officials will go to, to avoid a problem.”

Cryptomillionaire: the Smartest Guy at the Table (for now)

My reflections on a certain real estate bubble and how it seemed similar to his acute certainty of how the future would progress made no dent in his enthusiasm.

Big Apple Cabbies and Credit Unions Suffer, while Big Money Circles

A medallion being essentially a license to drive a cab, $150,000 to $450,000 doesn’t seem like the bottom, however at the peak. 2014, a medallion went for $1.3 million. By the way, Uber was founded in 2009, but New York cab owners either didn’t get the memo, or didn't understand the implications.

Legalization Creates Violence and Product Shortages

Pot is available everywhere and only when government gets in the way does supply become a problem. The California growers association worries, as Thomas Fuller writes, “there may not be enough regulated marijuana to serve the legalized market, a highly paradoxical situation in a state that is by far the largest cannabis producer.”

Hell Hath No Fury Like a Crypto-Bubble Denier Scorned

Crypto fans might wonder what the “craft” refers to. Grant’s believes the burgeoning digital currencies have more in common with craft beers and government fiat currencies than Krugerrands, Eagles and the golden like.

Business Rebel Plays the Austrian Business Cycle (and wins)

Zell explains that entrepreneurs think differently. “It’s about how you perceive the world,” he writes. “Entrepreneurs are the ones who are always looking for opportunities to do things better. They don’t just recognize problems; they see solutions.”

What Could Go Wrong: Flight Attendants & Chimney-sweeps

The Elliott Wave folks remind us, “It’s always like this in the end. The easy way becomes the obvious way. In this case, all a person has to do is push a button and literally create money. What could go wrong?”

Meet the New Nonprime, Same as the Old Subprime

there's nothing shady or menacing about the business of subprime. On the contrary, they say, specialist lenders in this area are performing a vital service for the world's largest economy

Real Estate: the investment the common people know they want and deserve to get good and hard.

But there’s one big reason why the rich still come out ahead -- instead of stocks, the middle class puts a large share of its wealth into residential real estate. Houses tend to earn lower returns than stocks.

Vultures Wait for the Cluster of Errors

The big monied real estate players know this real estate boom is long in the tooth and are raising money to buy up the distressed pieces when the time comes.

Americans Back to Borrowing a Lifestyle

Wages aren’t going anywhere so, “For most Americans, whose median household income, adjusted for inflation, is lower than it was at its peak in 1999, borrowing has been the answer to maintaining their standard of living,” Golle writes.

Fed Policy: Conundrums and High Priced Junk

“Because asset prices aren’t part of official inflation measures, and because identifying an asset bubble is beyond their scope, central bankers eschew using monetary policy to respond to them.”

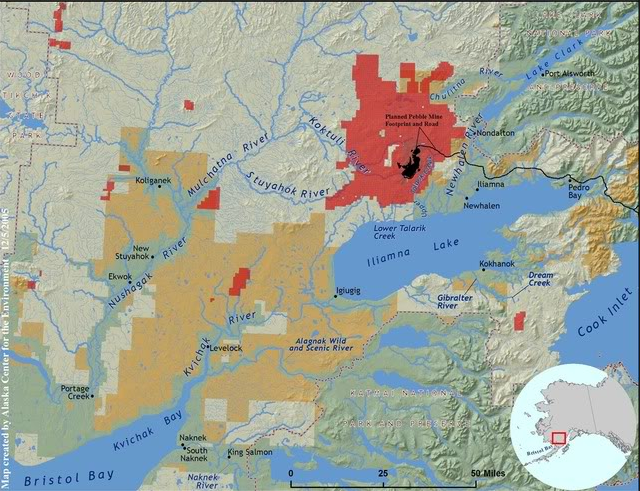

The Politics of Mining

The big three miners have cut their collective debt in half from 2014 and now the question is what do they do? “The question for investors is whether miners will continue to pay down debt—and boost dividends—or, lured by rising commodity prices, return to the big-spending ways that got them into trouble two years ago,” writes Patterson.

Dalio Says Get Yourself Some Gold

Here we are a few months later and Dalio says, batten down the hatches. “As a rule, periods of lower risk/volatility tend to lead to periods of greater risk/volatility.”