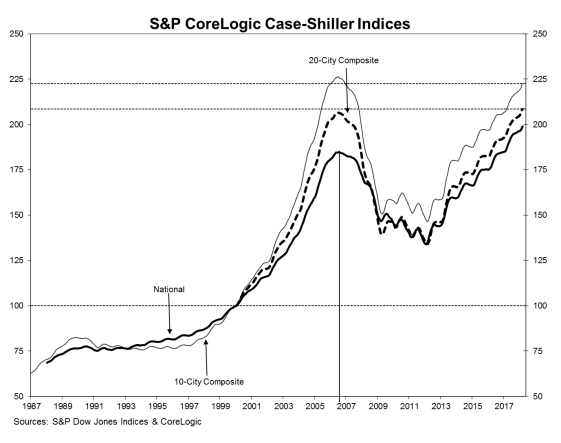

To refresh our memories, Jurow says, “2006 was just insane. 320 billion dollars taken out in cash just in that year, and boy, the debt helped the economy continue, even though things were showing signs of real problems.”

All in Las Vegas Market

The Hidden Housing Crisis

Most believe it’s clear sailing for housing. Jurow’s view its anything but rosy for housing. He believes the housing rebound is a mirage orchestrated by lenders and mortgage servicers keeping foreclosed homes and subprime loans in serious default off the market. In other words, there are millions of homes just waiting to hit the market. Sometime.

Las Vegas Apartments: Gambling on the Future, Using Today's Numbers

Apartment developers’ tea leaves tell them Millennials will always be renters, willing to pay handsomely for cool creature comforts: climbing walls, coffee bars, and concierge service. Average rents in Las Vegas rose from $900 in Q3 2016 to $1,059 in Q4 2018. On Sunday, the local paper featured a new mid-rise project with successful Millennial written all over it.

CTE, the New Asbestos

What could go wrong? Insurance? Or, lack of it? Insurers are leaving the football market fearing Chronic Traumatic Encephalopathy (CTE) is the new asbestos.

Freddie Mac Economist: Housing Dip is a 'Mental Recession'

“We’re in a mental recession,” chief economist at Freddie Mac Sam Khater told the Journal (presumably with a straight face). “It’s a constant stream of negative headlines for a couple of months…it wears on you.”

Housing Affordability Down, Inventory Up

For those believing this is the pause that refreshes, James Stack thinks otherwise. “Housing could be heading for its worst year since the last housing crash," Stack, 67, said told Bloomberg in a phone interview. “Expect home sales to continue on a downward trend in the next 12-plus months. And there’s a significant downside risk to housing prices if a recession takes hold.”

Can Raiders Arrive Fast Enough to Save Housing Market?

Vegas was the hottest market in country two months ago, now, not so much. But home sellers are telling their realtors to check the paper for the business section headline, “Las Vegas home prices rising fastest in country, still.” Those kind of headlines have sellers listing their properties for $20,000 to $40,000 too much, realtors tell me.

Low CAPs, Clear Crystal Balls

Can rental rates keep climbing? Will interest rates remain low forever? Griffin Capital seems to think the answer to both questions is ’yes’.

California Housing Funk Crosses Boarder to Nevada

With California being Nevada’s primary feeder market, what happens in California won't stay there, but migrate to Nevada.

Irrational Apartment Exuberance

Those “high rents” I referred to are now commonplace around the Las Vegas valley. I toured a project recently, located far from the strip, but with all the bells-and-whistles the Lotus has, and the owner told me he is earning $1.80/sf a month. He told me his project wasn’t for sale. We’ll see.

Can Vegas Ever Build Too Much Convention Space?

Is it possible, Las Vegas, which already has more exhibition space, by many multiples, than any other U.S. city, might build too much convention space? That more space won’t automatically turn into more heads in beds at premium prices?

Housing Top is In

The interest rate which most influences mortgages is the 10 yr treasury which has increased nearly 200 basis points since it’s bottom in the summer of 2016. The latest 30-year mortgage rate per investing.com is now at 5.05% a huge jump from the 3.6% two years ago.

Housing: Rates Up, Demand Down

However, homebuyer mood has changed. Be it increased interest rates or Trump’s Tweets & Tariffs show, I’m told by those selling homes that buyers that were bullish with a capital B, a couple months ago. are now, not so much.

Las Vegas: How Long can the Expensive Drunk Last?

Las Vegas hotels are more in the space renting business than the games of chance business. Want a place to sit while you tan at Encore? Ms. Bond writes, “Prices can range from $5,000-ish for a daybed to $10,000 for a “water couch,” a 10-person table-sofa-lounge combo situated in a shallow part of the pool.”

Vegas's Greatest Week?

It used to be that the only stick men that mattered were at the city’s craps tables pushing dice and barking “new shooter coming out.” A hockey puck was what Don Rickles called the dim witted. Now the town is cuckoo for hockey as the Golden Knights skate against Washington D.C.’s Capitals for the Stanley Cup.

Las Vegas: Prices Increase for Housing and Parking

Despite a shortage of labor, builders have pulled over 4,000 permits for new home construction through this year’s first four months a 33 percent increase from a year ago. Andrew and Dennis Smith ominously write, “This also marks the first time since 2007 that we have reported more than 1,000 permits pulled in two consecutive months.”

Malamud Retires, Remembering Rothbard

Imagine how different the History of Thought class was with Rothbard (his 2 volume “An Austrian Perspective on the History of Economic Thought” was essentially his lectures) as opposed to Malamud’s version.

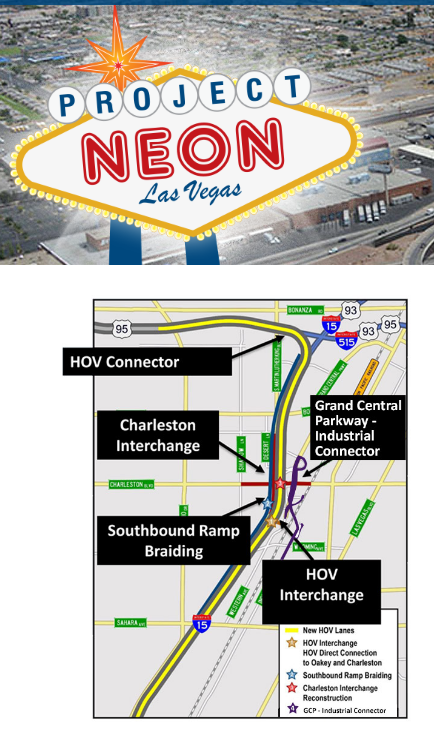

Sideways Skyscraper Curse

What those of us in Vegas are wondering (h.t. Jeff Barr); wouldn’t the skyscraper curse apply to large scale public works projects? The improvements are horizontal instead of vertical, but what happens at the end of massive highway infrastructure projects like the ones continuing in Las Vegas.

The New American Way: Get High and Shop Online

This is a new segment of the industrial real estate market that is being created in front of our eyes,” George M. Stone, a longtime real estate executive now focused on the pot business told Gelles. “It’s a huge industry and only getting bigger.”

Little Inventory, Plenty of Squatters

What Tina and Smith don’t mention Eli Segall does in the Las Vegas Review-Journal,”Some 2.17 percent of homes in the Las Vegas area, or a total of 14,334 properties, are vacant