Jimmy Webb, writes in his new book The Cake and the Rain, “My imagination soared under the influence of these Beatles (and “world class LSD”). Sgt. Pepper was nothing less than a heroic album. It was as important as any music ever written.”

Sin City Cash Burning

The Vegas convention sweet spot on the calendar has come and gone and I figured that would be his explanation for the tepid market in rides. No, he said it's a supply problem. Too many drivers. He told me,

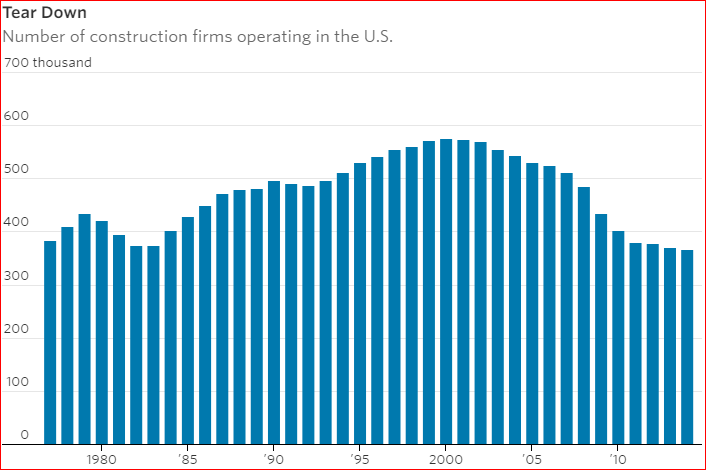

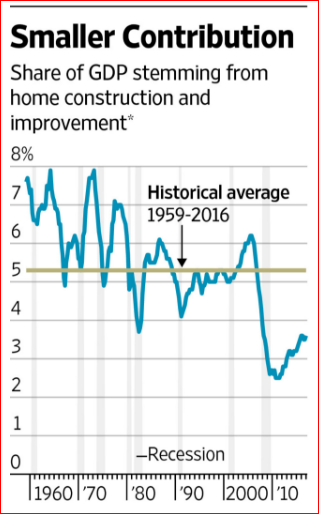

Less Supply = Higher Priced Homes

The shortage of supply, increases in costs, and millennials finally catching the home ownership bug has median prices jumping. Nationwide, “the median was $316,200 last year versus $240,900 in 2005.”

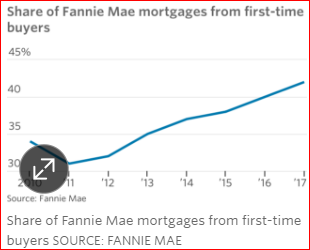

Millennials See White Picket Fences

“Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele,”

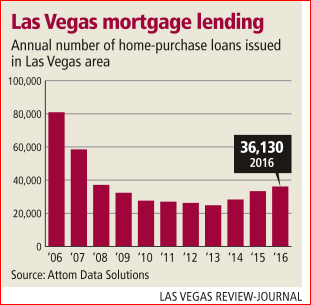

Las Vegas Housing

The home market is still highly sensitive to interest rates. Employment/building permits is an interesting ratio that for the moment looks good, but could flip in a hurry.

Bankers, the Last to Know

It seems Lord Keynes had one thing right when he wrote, “Banks and bankers are by nature blind. They have not seen what was coming…

Suddenly has Arrived

Despite nine full years of zero-to-slight interest rates, “suddenly” has arrived. “Total US bankruptcy filings by consumers and businesses in March spiked 40% from February

Getting Small Will Mean Sellin' with Yellen

No doubt it’s time. Grant’s Interest Rate Observer points to the Fed’s 111.7 to 1 leverage ratio this week and quips “the central bank’s financial documents come to look like exhibits from some Delaware bankruptcy-court proceeding.”

No Need For Government Force Legal Pot Will Make Higher Wages

McCurdy should notice what’s going on in Denver. “Colorado’s restaurant labor market is in Defcon 5 right now, because of weed facilities,”

More Houses, More Squatting

While economists are worried about too few houses being built, squatting in vacant homes has become an epidemic in Las Vegas,

Big Boom and Big Bust, Jiggle Lives On

As John L. Smith wrote, “Few have enjoyed as much success combining skinny girls and whiskey as Jack Galardi.”

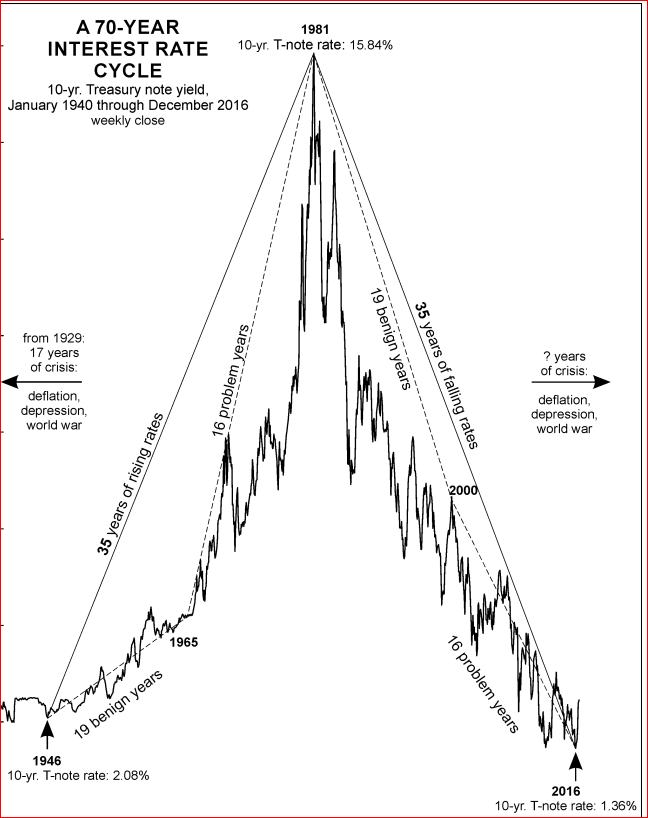

Old Fed or New Fed, Rates are Headed Up

does the Fed really set interest rates or follow the market?

Trading Bad Paper Helps Underwater Homeowners

In the short term Gov’t Sachs is looking to satisfy its debt to society, but in the long run they think they can make some money at this.

Buyers Buy, When Lenders Lend

So why the rosy scenario? Americans figure the coast is clear, their jobs are safe, America is gonna be great again.

Las Vegas: Too Many Dealers, Too Much Bad Credit, Just the Right Number of Lawyers

Boohoohoo, we’re lightly burdened with Legislators at 11 percent, Urban regional planners at 42 percent, and Social scientists at 45 percent.

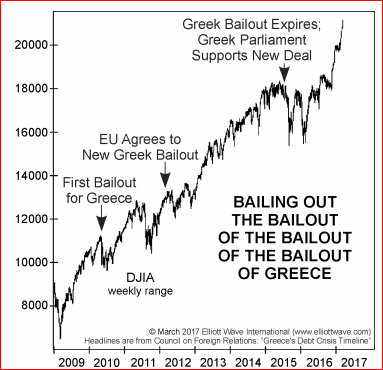

Grexit Spells Trouble For Trump's Bubbleland

Investors may have forgotten that the U.S. market swoons when Greeks get handouts. July will be here soon and the Greeks owe a $7.42 billion bond payment they have no hope of paying.

Lawyers Cry Crocodile Tears, While Their Clients Dance On

“They’re a hard demographic to represent,” lawyer Leon Greenberg told Allie Conti of vice.com. “The girls who are into it are making a lot of money, so it’s easy to say, ‘Oh, we’re getting $500 or $1,000 or a couple of thousand dollars for a day or night’s work.’

Clouds Over 2018

t’s as the Austrian economists predict: when the monetary accommodation ends, it’s time for the cleansing of malinvestments to begin.