It would indeed be ironic if Donald Trump of all Presidents would get behind 86ing 1031s.

Polish Maverick's Place Peddled Again

Eighth-grade graduate Bob Stupak had built the Stratosphere from nothing and $550 million from someone who couldn’t have been paying attention and opened in April 1996, at the time, the 3rd most expensive hotel-casino project in Las Vegas history. The self-proclaimed Polish Maverick was bankrupt three months later.

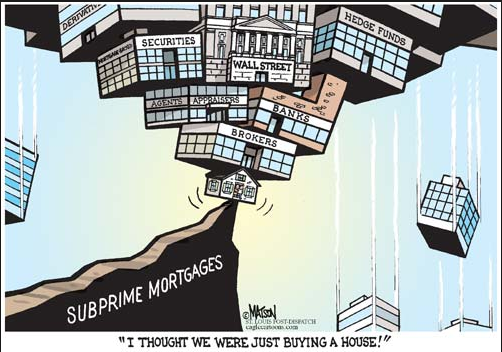

Help Wanted: Lenders with No Experience (or Short Memories) to Make Risky Mortgages

Of course there’s a good market for loans to folks who don’t fit in the Dodd-Frank box and lenders can earn 6% to 10% from borrowers sporting credit scores of 660 and below. But fresh-faced originators can’t figure out how to make the loans.

Flip It, Flip It Good

Las Vegas house flippers booked an average gross profit of $51,500 per deal in the first quarter. That’s up 29 percent from the same period last year and the biggest haul since at least early 2005

Tesla: Automobile Rent Seeker

After state government paid $43 million to brothel owner Lance Gilman for Tesla’s land and now has forked over another $59 million in transferrable tax credits, taxpayer have “invested” $214,000 in each $22.00/hour job.

Illinois Heads toward Bankruptcy, while Bankrupting its Citizens

Without legislative action, Illinois will be the Greece of the USA Zone after “Moody’s followed S&P’s downgrade Thursday, citing Illinois’s underfunded pensions and the record backlog of bills that are equivalent to about 40 percent of its operating budget.”

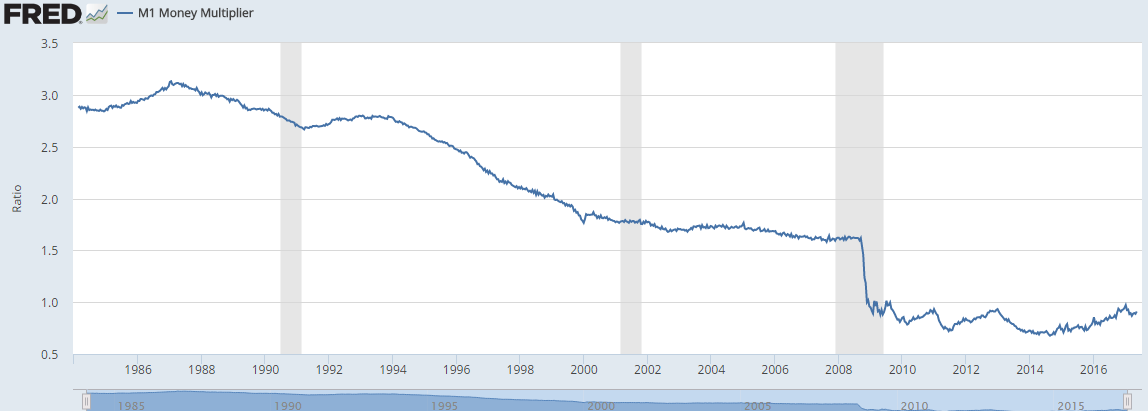

Credit now Repaired, Money will Multiply

An increase in lending might just kick start the money multiplier and then some honest-to-goodness, noticeable, government-can’t-deny-it price inflation might be just around the corner.

Up, up and Away, or Grinding to a Halt?

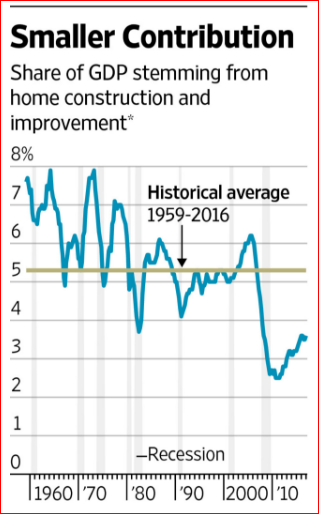

instead of leading the turn as they normally do, new home sales have lagged, both in time and quantity. A yawning gap has opened between the rate of growth in full time jobs, and the new home sales rate.”

Millennials, You Don't Need No Stinking Down Payment.

The American dream of paying on a big fat, paycheck sucking and mobility stifling mortgage is just waiting for you. Take the plunge. Make America great.

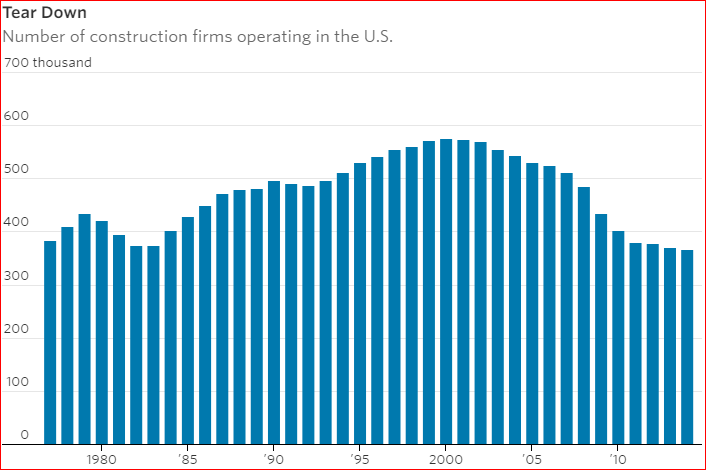

Shortage of Hammer Swingers

“Construction labor costs are rising an average of 4% to 5% annually, outpacing inflation, according to Anirban Basu, chief economist of the Associated Builders and Contractors. ‘The situation is going to get worse,’” he told Grant.

The Cake, the Rain, and Positive Mood

Jimmy Webb, writes in his new book The Cake and the Rain, “My imagination soared under the influence of these Beatles (and “world class LSD”). Sgt. Pepper was nothing less than a heroic album. It was as important as any music ever written.”

Sin City Cash Burning

The Vegas convention sweet spot on the calendar has come and gone and I figured that would be his explanation for the tepid market in rides. No, he said it's a supply problem. Too many drivers. He told me,

Less Supply = Higher Priced Homes

The shortage of supply, increases in costs, and millennials finally catching the home ownership bug has median prices jumping. Nationwide, “the median was $316,200 last year versus $240,900 in 2005.”

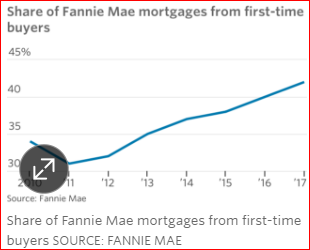

Millennials See White Picket Fences

“Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele,”

Las Vegas Housing

The home market is still highly sensitive to interest rates. Employment/building permits is an interesting ratio that for the moment looks good, but could flip in a hurry.

Bankers, the Last to Know

It seems Lord Keynes had one thing right when he wrote, “Banks and bankers are by nature blind. They have not seen what was coming…

Suddenly has Arrived

Despite nine full years of zero-to-slight interest rates, “suddenly” has arrived. “Total US bankruptcy filings by consumers and businesses in March spiked 40% from February

Getting Small Will Mean Sellin' with Yellen

No doubt it’s time. Grant’s Interest Rate Observer points to the Fed’s 111.7 to 1 leverage ratio this week and quips “the central bank’s financial documents come to look like exhibits from some Delaware bankruptcy-court proceeding.”

No Need For Government Force Legal Pot Will Make Higher Wages

McCurdy should notice what’s going on in Denver. “Colorado’s restaurant labor market is in Defcon 5 right now, because of weed facilities,”

More Houses, More Squatting

While economists are worried about too few houses being built, squatting in vacant homes has become an epidemic in Las Vegas,