Boehm points out that the 300 hundred jobs came to life after “American companies have paid about $690 million in tariffs to the federal government.” That works out to $2.3 million per job we know about or $300,000 per possible job.

Tweets, Bondies & Junky Monkeys

the market believed Jerome Powell sounded all lovey dovey with his comments after last week’s Fed pow wow. But, Business Insider says the “junky monkeys” didn’t hear Powell right. BI says the “bondies” are the real Powell whisperers.

The Trouble with CoCo

CoCos are similar to trust preferred debt that community banks in the U.S. stuffed balance sheets with in the early 2000s. While trust preferred was debt, the terms were so liberal, banking regulators allowed banks to count the debt as equity.

Golf Goes the way of Wrestling

Golf is game that is dying with the Greatest Generation and Baby Boomers. Golf peaked even before 2009 when Woods wrapped his SUV around a tree, escaped then wife Elin’s attempt to take a divot out of the 14-time major champion.

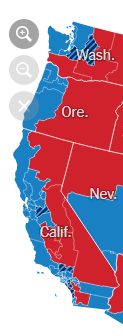

Trump Bump in Housing Turns into Trump Dump

Orange County “nut country” went bluer than blue on election night. Was it Trump’s fault, or maybe the Trump Bump has turned into Trump Dump in west coast housing and voters voted their falling property values.

Irrational Apartment Exuberance

Those “high rents” I referred to are now commonplace around the Las Vegas valley. I toured a project recently, located far from the strip, but with all the bells-and-whistles the Lotus has, and the owner told me he is earning $1.80/sf a month. He told me his project wasn’t for sale. We’ll see.

Dicey Bloated Government

This time, Lewis manages to find diligent, creative federal government employees (he had two million to choose from) to tell the story of Trump’s transition, or lack thereof. The thesis is, we are all at risk due to the President’s neglect. Legions of earnest federal workers were ready to smoothly hand over the monstrosity that is the federal government, and, well, no one showed up.

Can Vegas Ever Build Too Much Convention Space?

Is it possible, Las Vegas, which already has more exhibition space, by many multiples, than any other U.S. city, might build too much convention space? That more space won’t automatically turn into more heads in beds at premium prices?

The NFL: Land of the Caligulas

It is “the Membership,” who are the “puffed-up billionaires who own the store,” writes Leibovich. “These are the freaks, the club that Trump couldn’t crack.” On the next page, the author refers to the Membership as “bespoke Caligulas.” He goes on about how much TV time the owners receive as “presiding plutocrats.”

When Currency Crashes There's No #metoo, Just Do What You Have to Do

While #metoo is sweeping American culture, it’s do what you have to do where the currency and economy have collapsed. For now the U.S. dollar is strong and all is well. Meanwhile Bloomberg headlines recently screamed, “Treasury Sees 2018 Borrowing Needs Surging to $1.34 Trillion.”

Lucky Numbers, Lucky Drill Holes

Still, the feeling of “someone is bound to be win, so it might be me” is hard to shake: In one British survey, 22% of people said they would win the national lottery jackpot during their lifetime.

I thought Brits were more sensible than that.

Karshkari Tells Powell to Stop Raising Rates and Hopes Trump Takes Notice

Today his op-ed appears in the Wall Street Journal urging the Fed’s home office to lighten up on the interest rate hikes already. The President must be pleased.

Optimism Abounds, Dark Clouds Circle

The economy is great we’re told. Vote Republican and get more of it. “It” being--winning. However, the KBW Bank Index hit a 52-week low today. The index of small bank stocks is getting hammered. The index of European bank stocks continues to be bludgeoned by the market. And, the home builder’s index peaked in January, with big builders Lennar and DR Horton now making 52-week lows.

The Real Rialto

However, that’s not what Rialto is (or was) at all. Rialto Capital Advisors conducted day-to-day management and workout of 3.05 billion in loans the Federal Deposit Insurance Corporation (FDIC) received after it closed down banks during the financial crash.

Tall Buildings, Mighty Crashes

Mark Thornton’s “The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century” couldn’t be more timely. As we slide from boom to bust, the thoughtful and curious will want answers. Thornton has them.

Housing Top is In

The interest rate which most influences mortgages is the 10 yr treasury which has increased nearly 200 basis points since it’s bottom in the summer of 2016. The latest 30-year mortgage rate per investing.com is now at 5.05% a huge jump from the 3.6% two years ago.

Kirk Kerkorian: Misesian Entrepreneur

Kerkorian began his art early, by necessity. “When you’re a self-made man you start very early in life…,” Kerkorian said. “You get a drive that’s a little different, maybe a little stronger, than somebody who inherited.” Unlike a certain president of the United States we know. Rempel starts his first chapter with a quote from Mark Twain, “Necessity is the mother of taking chances.”

An Anointed Son, A Reporter Scorned

Dana Gentry’s “The Anointed Son: A True Story of Greed, Power and Blind Trust” is a book, not about low rates, but high ones. While the prime lending rate was 4 percent in 2003, Las Vegas real estate developers would borrow at rates of 12 percent up to 15 percent in pursuit of cashing in on the real estate boom.

Housing: Rates Up, Demand Down

However, homebuyer mood has changed. Be it increased interest rates or Trump’s Tweets & Tariffs show, I’m told by those selling homes that buyers that were bullish with a capital B, a couple months ago. are now, not so much.

Dimwit Minimum Wage Logic

If Bernie were paying attention, there is a minimum wage experiment going in real time in Venezuela right now. Sure, there’s some serious money printing going on there and plenty of socialist schemes to keep the shelves empty. However, the fact there’s nothing to buy hasn’t kept Venezuelan president Maduro from hiking that country’s minimum wage 24 times since 2013 when he took office.