Turning Japanese, Again

Builder Magazine reports that one of the larger home builders in Las Vegas, Woodside Homes, is being acquired by Japan’s largest home building enterprise, Sikisui House. Woodside is one of the few major private home builders still active in Las Vegas, as well as California, Phoenix, and their home state of Utah. In 2016, Woodside pulled 340 permits in the Las Vegas metropolitan area, ranking them 11th

Woodside filed for Chapter 11 bankruptcy in 2008, emerged in 2009 and now fetches a price of $468 million.

John McManus writes “Sumitomo, Mitsui, the long-time majority shareholder of SoCal-based MBK Homes, and Sekisui House are together becoming a materially important, scaled investment in new residential construction in the United States.”

Sumitomo Forestry wants more land to become "a leading homebuilder in the United States," with the goal of building 5,000 homes across its four operational spheres: Henley USA (Seattle), Bloomfield Homes Group (Dallas), Gehan Homes (Austin, Dallas, Houston, San Antonio, and Phoenix), and now, Dan Ryan Builders, along with Woodside.

It wasn’t so long ago there was a worry the Japanese were buying up America. But it didn’t work out so well. The Chicago Tribune lists some famous failures.

Mitsubishi Estate Co. paid the Rockefeller family $1.4 billion for an 80 percent stake in the complex in 1989 and 1990. By early 1995, Mitsubishi had lost more than $600 million on its investment and put the property under bankruptcy protection. Late last year, it decided to hand the property over to its lenders.

Aoki Corp. of Japan, which bought the Westin Hotels and Resorts chain in 1988, hasn't fared much better. In 1988, it paid United Air Lines' parent Allegis Corp. $1.35 billion for the company. It ended up selling the chain's North American and European operations and some other assets to two U.S. investment firms for $561 million in December.

Japanese real estate developer Minoru Isutani's purchase of the Pebble Beach golf resort is another famous case. In 1990, he bought the California championship golf course for $841 million. Isutani sold the property about 18 months later to two Japanese companies at a $340 million loss.

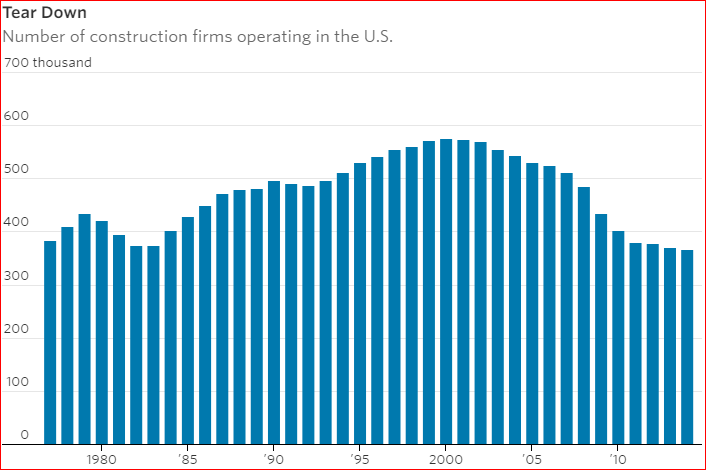

Will their timing be better this time?